Overview

Hurricane risk is distorting property markets in places most people don’t expect. It’s reshaping who can buy, who can sell, and who gets left behind.

- Homeowners in seemingly stable markets are discovering their properties are losing value. Not because of location but because of insurance costs or availability.

- These liquidity traps are spreading beyond Florida into unprepared communities in Virginia, the Carolinas, and along the Gulf of Mexico (which was renamed by the Trump administration to the Gulf of America).

- Risk transparency and smarter mitigation are no longer optional. They are now the path to preserving home equity.

2025 hurricane risk report

Mr. and Mrs. Jones spent 50 years building a life in Virginia Beach, Virginia. Careers, children, and community were all carefully created in this tight-knit coastal area. But with their kids and grandkids living elsewhere and the costs to maintain their family home disproportionate to their retirement income, they decided it was time to downsize and relocate.

They thought their ocean-adjacent home would sell in hours. But months after the initial listing, the home sat waiting and the Joneses began to worry. Despite a few price drops, a new coat of paint, and even a concession to buy down the interest rate, no offers arrived.

In a market where national home price growth has stagnated — albeit at often unaffordable price points — and inventory is at an all-time low, why are seaside enclaves that are seemingly far removed from hurricane patterns passed over by would-be buyers?

“Buyers are factoring environmental risk factors into their decisions in ways we haven’t seen before,” said Cotality Chief Economist Selma Hepp. “They’re pricing in insurance premiums, future storms, and the potential for resale challenges. That’s reshaping demand in coastal markets, even in areas with minimal storm history.”

Balancing the costs of beachside living has long been tenuous, but many areas are seeing that parity tip as the risk of flooding and wind damage grows. As the risk profile of the U.S. coastline evolves, the once-invisible risk associated with hurricanes is resulting in increasingly visible consequences to homeowners’ wealth.

In this report, Cotality experts examine the growing financial and social costs of increasing hurricane risk in areas that may not be as seasoned at weathering the storm.

Hurricane risk is not just a Florida problem

Communities from Port Isabel, Texas, to Bar Harbor, Maine, are faced with flood and wind risk that threaten wealth and security. With hurricane risk intensifying and coverage retreating, the question isn’t if other communities will feel the effects – it’s where.

Charleston, S.C., Wilmington, N.C., and Virginia Beach, Va. are not the typical suspects for hurricane risk. However, these cities are home to over 656,000 homes at risk of flooding if a major hurricane makes direct landfall.

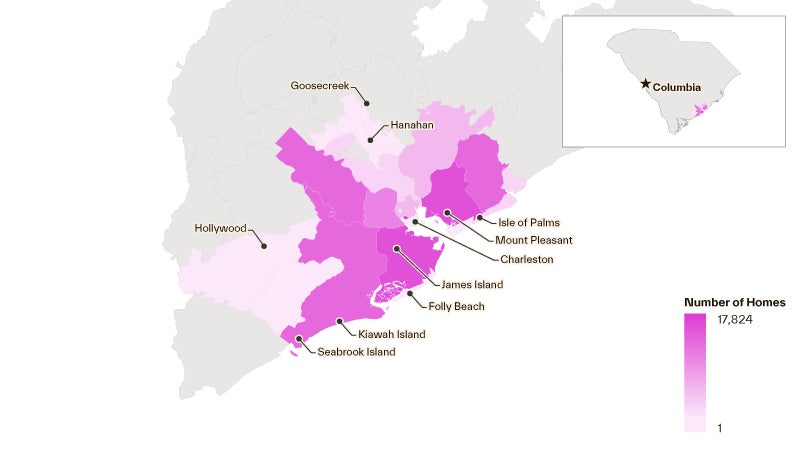

Number of homes with moderate or greater storm surge risk by ZIP code in Charleston, S.C.

*Data was analyzed for selected ZIP codes within the Charleston metro area

Data source: Cotality, 2025

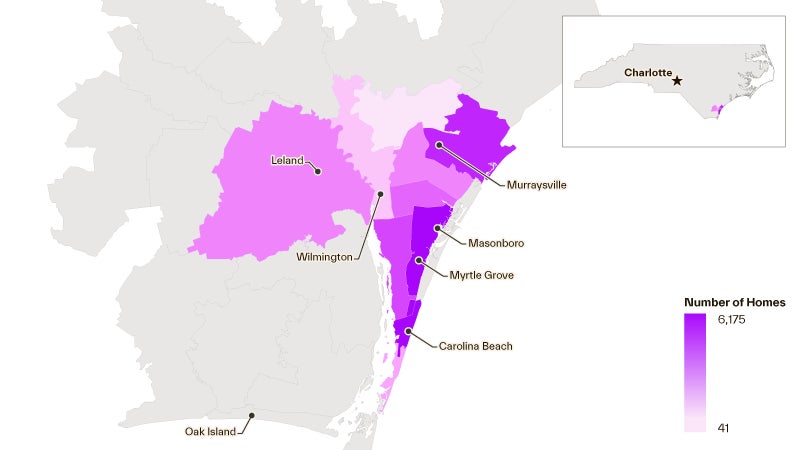

Number of homes with moderate or greater storm surge risk by ZIP code in Wilmington, N.C.

*Data was analyzed for selected ZIP codes within the Wilmington metro area

Source: Cotality 2025

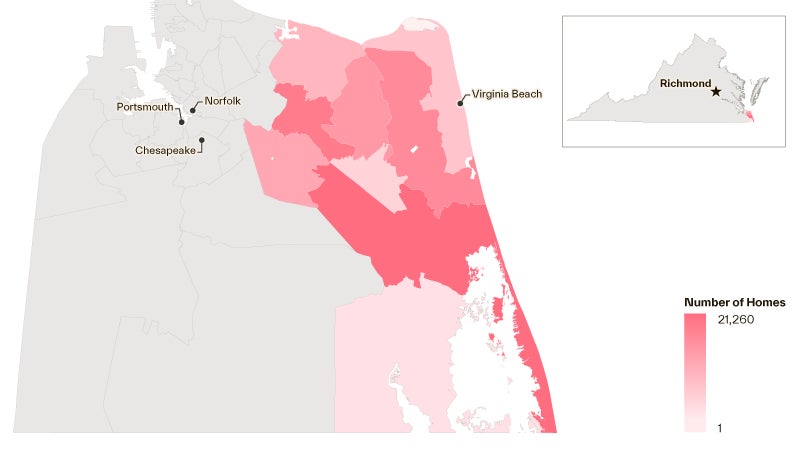

Number of homes with moderate or greater storm surge risk by ZIP code in Virginia Beach, Va.

*Data was analyzed for selected ZIP codes within the Virginia Beach metro area

Source: Cotality 2025

This risk reduces the appeal of homeownership in these areas, leaving homeowners saddled with precarious properties for longer periods. Cotality data shows homes in Virginia Beach, Va. stayed on the market 32% longer in 2025 than in early 2024. During the same period, Wilmington, N.C. homes lingered 19% longer.

But risk spreads beyond these state boundaries.

Nationally, Cotality identified more than 33.1 million residential properties, spanning from Texas to Maine, with a combined reconstruction cost value (RCV) of $11.7 trillion at moderate or greater risk of sustaining damage from hurricane-force winds.

Number of homes and associated RCV with moderate or greater risk to hurricane wind damage by state.

Data source: Cotality, 2025

Cotality also identified more than 6.4 million residential properties, ranging from Texas to Maine, with a combined RCV of $2.2 trillion at moderate or greater risk of sustaining damage from storm surge flooding.

Number of homes and associated RCV with moderate or greater risk to storm surge damage by state

Data source: Cotality, 2025

The cost of not paying attention to the risk is both social and financial. If ignored, it can lead to declining local property values, displacement of long-time residents, and mounting pressure on public resources as infrastructure and emergency systems are pushed beyond their limits.

Rising waters, falling property values

Buyers increasingly expect discounts for flood zone properties. A Cotality study found that homes sitting within Miami’s 100-year flood zone saw a reduction in value of between 9% and 18% per square foot. But those discounts are often offset by the increasing cost of insurance. And that’s if insurance is available.

In high-risk states like Florida and Texas, some insurers have gone bankrupt or exited the market, putting pressure on state-backed insurers. While Virginia and South Carolina haven’t seen exits on the same scale as other states along the Gulf, rising premiums from providers signal strain, especially in coastal areas.

With fewer private insurance options, homeowners either pay inflated premiums or forgo adequate coverage. This affects who can qualify for a mortgage — mortgages require insurance, so a lack of coverage locks out buyers without the ability to pay in cash, shrinking the buyer pool. Rising insurance costs are reshaping who can afford coastal homes, with young and middle-income buyers often priced out due to high insurance premiums that can push monthly costs beyond affordability.

Shrinking buyer pools means homes sit longer, prices fall, and neighborhoods change. Local families are replaced by investors or second-home owners, leading to weakened community ties. In extreme cases, too many vacant homes can discourage investment and future buyers, precipitating a decline in property values that erodes equity and generational wealth.

This has increasingly left homebuyers, real estate developers, lenders, and local governments to contend with a new reality — one where hurricane risk is pushing people to safer locations where they can buy a home.

A nation of migration

Migration patterns within Florida already reflect growing concerns surrounding the risks of coastal living. Data shows that many residents are relocating from high-risk areas like Miami to inland cities like Orlando, where storm surge risk is lower. Moreover, economics are pushing people to cheaper inland locations. Between 2019 and 2023, just over 500,000 people migrated within the state to cheaper markets like Tampa, Jacksonville, and Orlando.

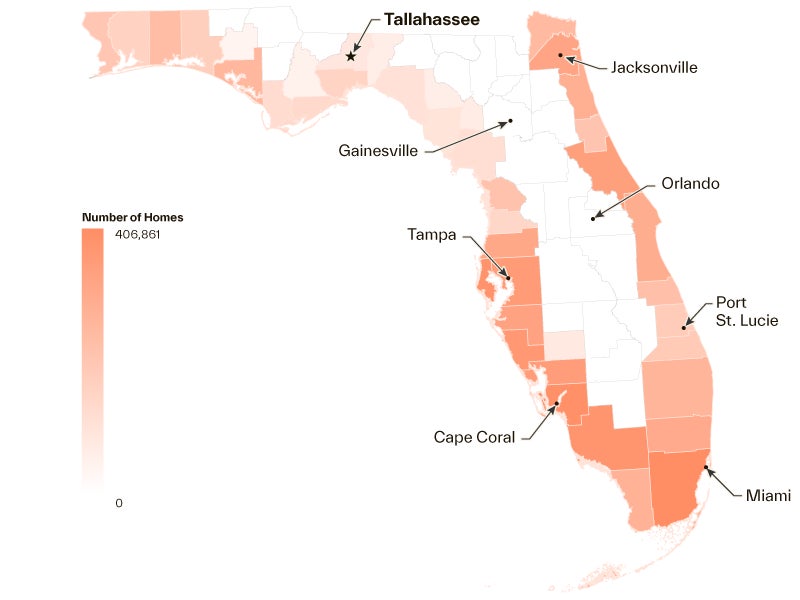

Number of homes with moderate or greater risk to storm surge flooding by county in the state of Florida

Data source: Cotality, 2025

There are also indications that Floridians are leaving the state. Mortgage applications from both in-state and out-of-state buyers are declining, and more Floridians are applying for loans elsewhere, particularly in neighboring states. According to a Cotality analysis, 48% of mortgage applications from people leaving Florida are for homes in Georgia, North Carolina, South Carolina, Tennessee, and Texas. This trend is no coincidence; when compared to Florida, these neighboring states tend to have lower housing costs and face less natural disaster risk.

States receiving mortgage loan applications from Florida residents

Data source: Cotality, 2025

While many people fleeing Florida’s high-risk coasts are relocating to the Carolinas in search of perceived safety, this shift can be problematic. The Carolinas, especially coastal and low-lying regions, also face some of the highest hurricane risk in the country. This false sense of security can leave homeowners vulnerable to both financial and physical loss, especially in communities where building codes, emergency planning, and insurance systems haven’t yet adapted to rising storm intensity.

“When homeowners underestimate risk, they’re less likely to invest in resilience,” said Howard Botts, Chief Scientist at Cotality. “That’s a serious problem in places where codes haven’t caught up to environmental realities.”

However, migration away from coastal areas doesn’t reduce the total number of homes available. As more housing stock sits on the market in at-risk regions, prices are likely to decline. This can leave homeowners with underwater mortgages or with a property worth far less than they anticipated, undermining the wealth they’ve spent years building.

Flood risk sinks infrastructure — and home values

The post-Hurricane Helene images of Asheville, N.C., remain vivid: miles of washed-out roads, cars rendered undrivable, and overflowing sanitation systems. The hurricane catastrophically damaged the city’s municipal water system, leaving many residents without running water. Raging floodwaters swept away buildings and bridges, and landslides severed access to major roads, effectively isolating the area.

Across the nation, floods caused by hurricanes routinely overwhelm infrastructure, knocking essential services like electricity, wastewater treatment, and clean drinking water offline for days or even weeks. These effects greatly threaten public health and degrade quality of life. But floodwaters don’t just threaten coastal communities.

Florida offers a sobering example of what hurricane floodwaters mean for communities situated at a seemingly safe distance inland. Storms can severely damage roads and bridges, which are critical to commuting and economic activity. Hurricanes can also remove access to basic requirements like drinking water. They have repeatedly crippled municipal water systems in Florida, which has forced residents to rely on bottled water and temporary sanitation solutions.

In 2022, Hurricane Ian brought devastating floodwaters to Arcadia, Fla. Although 50 miles inland from the Gulf Coast, Arcadia experienced catastrophic flooding when the Peace River overflowed its banks. The flooding submerged major roadways, cut off access to parts of the city, and overwhelmed stormwater and sewage systems, causing significant disruption to clean water access and sanitation.

The consequences of these disruptions had ripple effects: businesses closed, employees missed work, and recovery costs escalated. And that only accounts for the initial aftermath.

As neighborhoods struggle to rebuild basic infrastructure following a catastrophe, they can become uninhabitable, forcing residents to move. Mass departures slash local tax revenues, weakening the very municipal budgets responsible for rebuilding and improving resilience. This exodus creates a vicious cycle: weakened services drive out more residents, further draining local financial resources.

Resilience has proven key to shielding communities in hurricane-prone areas. Florida’s strict building codes have reduced storm damage compared to other coastal regions, but repair costs still climb into the billions annually. In areas with weaker standards and aging infrastructure, the risk is even greater.

Progress toward resilience is fragile and recent policy changes may reverse these advancements. On March 25, 2025, the Federal Emergency Management Agency (FEMA) stopped enforcing the Federal Flood Risk Management Standard (FFRMS), which applied to federally funded construction projects. Although this change may not directly affect private residential developments, it could weaken national flood risk mitigation efforts and jeopardize the integrity of future infrastructure projects.

“This rollback comes as flooding — especially in coastal states like Florida — grows more frequent and severe due to environmental factors and urban development,” said Chay Halbert, principal of public policy and industry relations at Cotality. “Expanding development in flood-prone areas without maintaining or enhancing protection standards increases environmental and financial burdens for future generations.”

Ignoring these risks comes at a cost. Higher flood risk drives away qualified homebuyers, depresses market values, and shifts local demographics. But cities can make smarter choices with the right data and planning. Urban planners increasingly rely on flood risk scores to guide zoning decisions, shape public investment, and inform infrastructure design. Incorporating risk into development isn’t just smart policy — it’s a necessary step to protect lives, stabilize communities, and safeguard long-term economic prosperity.

Rising to meet risk

Areas like Tampa, which weathered Hurricane Milton, and Asheville, which felt the brunt of Hurricane Helene, serve as cautionary tales of what can happen when risk is underestimated. These places were once considered relatively safe from major storms, but that reality is changing.

While the challenges facing coastal real estate markets are serious, they are not insurmountable. Insurance premiums, lending decisions, property values, and real estate trends are all influenced by risk, but that also means they can be managed with the right information.

Gaining insight into physical property risk can help identify areas where conditions are starting to shift and provide opportunities for early intervention. This awareness can help stabilize property values, protect communities from displacement, and ensure that homes and the wealth they represent remain secure for future generations.

.jpg)