Overview

Arizona’s real estate market is booming, but rising heat and water scarcity may threaten long-term stability. Despite environmental risks, investors and new residents continue to flock to the state, driving up prices and straining infrastructure.

- Phoenix ranks No. 4 nationally for investor home purchases, with small landlords leading the charge.

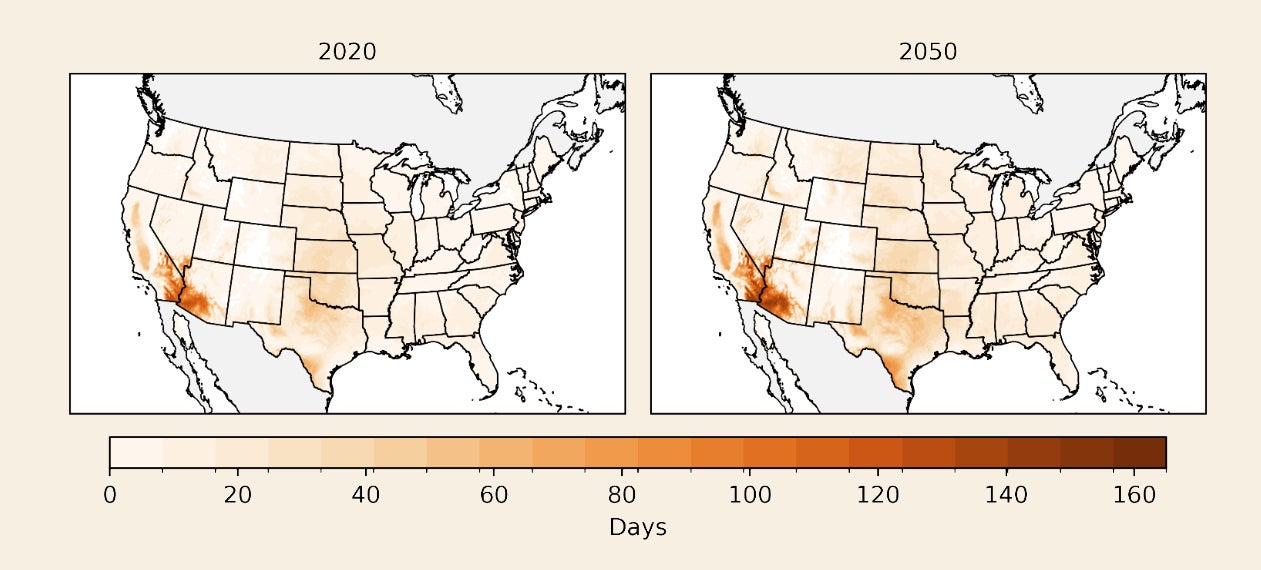

- Extreme heat days in counties like Yuma and Maricopa will rise 30–40% by 2050, impacting livability and public health.

- Water shortages are limiting new construction, making existing housing more valuable and more vulnerable.

- Migration trends show early signs of outbound movement, with residents heading to cooler, more affordable states like Texas and Colorado.

Arizona has long been a hot real estate market for retirees, young families, tech workers, and real estate investors. But now with the number of days above 110 degrees Fahrenheit climbing by double digits over the next 25 years, it may soon be simply too hot to live there.

Despite climbing temperatures, people searching for space, lower taxes, and sunshine are moving to Arizona in large numbers. New construction has boomed alongside this immigration. Investors have taken note. Phoenix is one of the top five cities for home investment purchases, according to Cotality data.

While today Arizona commands significant investment from homeowners, developers, and investors, the state’s forecast begs the question: will Arizona’s heat imperil its housing market?

Arizona’s markets are heating up

Over the next quarter century, Cotality forecasts that Arizona will be home to the four hottest counties in the nation. Already state temperatures are so extreme that heat-related fatalities are double that of Texas — another state at risk of extreme heat — despite having less than one-sixth of the population.

Some places, and the people living there, are facing particularly steep increases in temperature. Yuma County will have the greatest number of extreme heat days in the nation. The county will see a 33% increase in days above 110 degrees Fahrenheit by 2050, according to Cotality data. Maricopa County, where Phoenix is located, will see a 39% increase.

Top 5 U.S. counties' annual extreme heat days in 2050

Future 10-year average

Rising mercury levels haven’t yet deterred newcomers. Nearly 100,000 people moved to the state between 2016 and 2020. Forty four percent of those people went to the Phoenix area while Yuma County took in 2% of those new residents.

The rapid influx of people into Arizona has resulted in a housing shortage that has pushed up prices. In July, the median cost of a home sat $430,000, which is above the national median of $405,000. For many, Arizona isn’t seen as a high-cost desert destination, and these sticker shock price tags might slow down future population in-flows.

In Cotality’s From House to Home survey, 43% of recent homebuyers said that high housing prices led them to look for a more affordable alternative to where they originally wanted to live.

While price growth forecasts in the state have tempered as the U.S. market cools, investors still see Arizona as place for potential opportunity. In the Yuma area, Cotality data found that by July 2026, prices are forecast to outpace the national growth forecast and increase 3.9%.

Investor interest is risky business

Just over two-thirds of Arizonans are homeowners. Homeownership rates in Maricopa County — where over half of Arizona’s 1.8 million housing units are located — are about 2 percentage points lower, according to Census Bureau data. Those two points represent thousands of homes that are owned by landlords.

Investors snapped up 47% of Phoenix’s inventory in the first half of 2025, making the metro area the No. 4 spot for investor purchases in the U.S.

Most of those purchases are made by small-time landlords who own fewer than 10 properties. That means it’s people not institutions — institutional investment in the state declined 12% year over year — who are betting on Arizona’s future. They will also be the ones who will shoulder any fallout if the market stumbles.

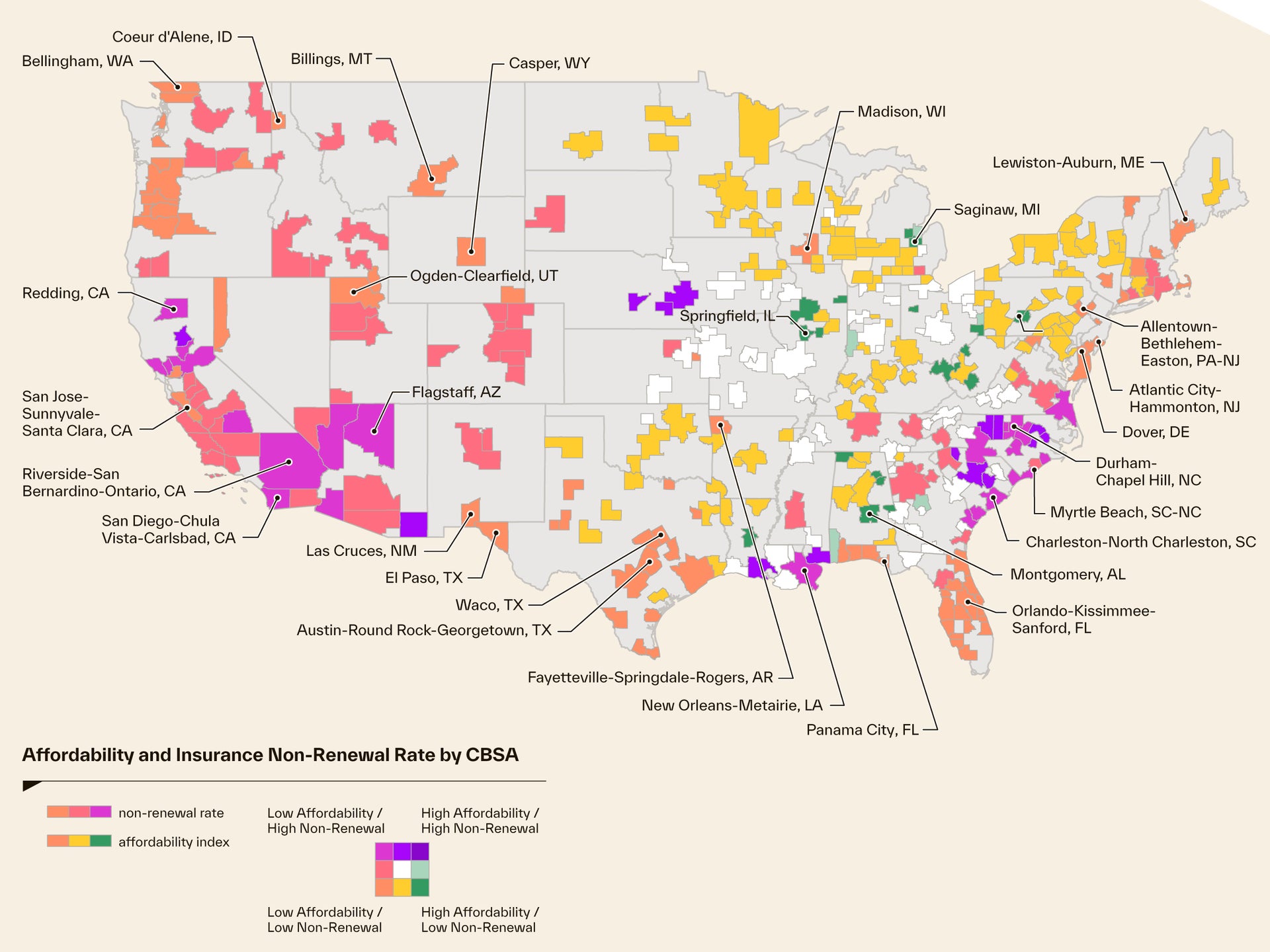

Investors are currently benefiting from rents that continue to rise year over year. However, more rental properties could raise rents and further reduce the already eroding affordability in this desert destination. Add in the expanding costs of homeownership like higher prices, elevated interest rates, increasing insurance and property taxes, and it won’t just be renters who feel the squeeze.

A recent spate of transaction cancellations that Cotality identified in the state signals that both investors and residents are thinking twice before making a long-term commitment to a market that is increasingly straining to support its population.

Growing pains

Extreme temperatures affect more than just air conditioner bills. Triple-digit temperatures can deform roads, stress the electrical grid, and harm public health. Water is also at risk.

Annual number of days above 100°F for 2025 and 2050

In 2023, Governor Katie Hobbs said that the state’s groundwater supply is about 4% short of demand. Since then, the state has seen cuts to its water supply allocations. In 2026, the state will lose 18% of its allocation from the Colorado River.

Water scarcity has already limited construction for developers that are unable to secure supply. Golf courses — one of the major attractions for the state — may also wither. The state government requires developers to prove a 100-year “assured supply" before it will grant construction permits. Obtaining that proof became even harder as Arizona weathered one of its worst droughts in 1,200 years.

High demand. Reduced new construction. Limited water supply. These factors have converged to make current housing in the state even more valuable — and vulnerable.

“If temperatures increase too drastically, it will dull the attraction of sunshine and low taxes that brought people to Arizona in the first place,” said Cotality Chief Scientist Dr. Howard Botts. “But adaptation is possible. With forward looking models and an understanding of how hot is too hot for certain construction choices or locations, we can create resilient communities across the American Southwest.”

As it stands, it is becoming increasingly pricey to insulate homes against the elements in Arizona. Cotality data shows that large swaths across the state have high non-renewal rates. That reality is a concern for many potential homeowners.

Where does insurance and home affordability coincide?

Data source: Cotality, 2025

For nearly a quarter of recent homebuyers, finding homeowners insurance proved to be the most overwhelming aspect of finding a new home, Cotality uncovered in its From House to Home survey.

Couple this with dwindling affordability and a heat index that is climbing past the point of safety, and some people may consider leaving the state for good.

Where to next?

While this desert state’s growth is still heating up, it’s a fragile balance. The first inklings that long-term investment may have a shorter shelf life than in other states are appearing.

People aren’t only coming to Arizona, they are also leaving the state. Migration data from Cotality shows that homeowners from the Grand Canyon State are leaving for California, Colorado, and Texas. These nearby states boast strong job markets, an array of natural resources, and cooler climes filled with plenty of sunshine.

Texas and Colorado also offer homes at price points that are accessible to Arizonans. Cotality data shows the median home price in July for each state was $343,000 and $552,300, respectively.

While the number of people leaving Arizona is just a trickle compared to the number coming in, the signals that this could change are there. Investors and developers should pay attention. As temperatures rise and water access dries up, those who call Arizona home may find that the future pulls them elsewhere. Without new residents, homes could sit empty and the potential promise of Arizona portfolios could become a liability.

Resilience will be a key measure to securing the state’s future. Using property data to get a sneak peek into what’s coming next will be key to determining if Arizona can adapt before it gets left behind.