59%

Gen Z homebuyers say the process of finding a home feels overwhelming

93%

Homebuyers with at least one moment of doubt, confusion, or pressure

68%+

Rank "comfort" above "convenience" and "loyalty" when working with industry professionals

90% of future homebuyers say some part of buying a home is overwhelming

Data source: Cotality survey, 2025

Introduction

.svg)

Who really owns the homebuyer?

At first glance, choice appears abundant in the world of homebuying — until it isn’t. Buyers scroll, apply customized filters, compare listings. But the finish line of those decisions is often — and unknowingly — predetermined. By credit models. By eligibility rules. By listing platforms that hint at personalization but favor the predictable.

The homebuyer no longer moves through the market alone. They’re filtered through industry agents, each nudging the outcome in different directions.

This tug-of-war has made buying a home anything but simple. In Cotality’s From House to Home survey of recent and prospective homebuyers in the U.S., nearly half of respondents said the homebuying process was more stressful than anticipated. This figure creeps up for Gen Z buyers, 63% of whom said they did not feel informed about the current real estate market.

Driven by decades of technology, advances in transportation, retail, and media, buyers expect more clarity and convenience across transactions big and small. However, when it comes to property, the complexity of the buying process can come as a shock in comparison. This is leading to shifts in who — and what — they trust when buying a home.

Agents once owned the homebuying journey. Local knowledge was enough to gain trust and loyalty. Now they’re squeezed by reduced inventory, shrinking commissions, shifting rules, and savvier buyers. Some are adapting, offering advice shaped by trends and supported by tech-enabled insights. Others lag behind, missing a new generation of buyers who expect guidance that reflects how they live, search, and decide today.

Tech platforms have stepped into the space. Interfaces promise ease. Algorithms anticipate preferences before they’re made explicit. But transparency and true understanding remains elusive. Listings don’t explain that flood maps in the area are about to update. Recommendation engines don’t necessarily explain why a pre-approval disappeared. Monthly mortgage payments don’t necessarily account for a future with rising insurance costs. The promise of a seamless integration for accurate insights too often falls short.

Lenders do more than fund. They open pathways to the dream of homeownership. Affordability shapes the edges of that ownership. With Cotality data showing the U.S.’s median home price at $403,000 in June 2025, people are concerned that the hope of homeownership is slipping out of reach. A 30-year fixed rate mortgage is harder to qualify for, and last year, only 68% of applications for these loans made it all the way through origination, according to Cotality data. The alternatives — shared equity, institutional rental stock, fractional finance — require specialized financing, but the requirements aren’t always transparent without lender insight.

Property insurance operates more quietly. It’s not something many potential homebuyers even consider when they excitedly open tabs of potential homes to share. But that doesn’t mean that its impact is any less decisive. A property may look viable on paper — but without coverage, the path to ownership closes. And with the number of storms surpassing 20-year averages, and natural catastrophe risk overlapping in many areas, billion-dollar disasters are becoming a familiar occurrence. Insurance costs reflect these trends. In these moments, it’s often an underwriter or an insurance agent who holds the final say, acting as both gatekeeper and guide.

Policy now plays a more active role in shaping markets. Commission models are under scrutiny. Flood risk is being reassigned. What once unfolded through market forces is increasingly directed by regulation.

To make sense of these converging forces, Cotality has brought together its global experts across housing, lending, insurance, and regulation. This series examines what the data says — and what it doesn’t. It looks beyond the market signals to the people behind them, and the forces reshaping how they buy, borrow, and move.

Algorithms or agents?

.svg)

Homebuying was supposed to get easier. Faster searches, personalized listings, instant approvals — platforms promised a revolution. What buyers got was more information — but less clarity.

The tools now shape the journey. But they don’t necessarily reduce friction; they reassign it.

Recommendation tools tend to favor what’s familiar. Mortgage systems are built around standard profiles. These approaches help streamline decisions, but they can overlook what makes each buyer’s needs different. That’s starting to shift, as some lenders explore more adaptive models, but it’s early. The risk is that buyers are treated by some as data points, not decision-makers.

Yet the industry keeps expanding its reliance on digital solutions. AI chatbots answer FAQs. Smart valuation tools predict pricing curves. Digital brokers boast 24/7 service. Every new feature implies that a people-centric approach is outdated. But few ask why homebuyers haven’t wholesale replaced humans nor have they confidently adopted tech-driven processes.

The cost of uncertainty

Confidence is typically a prerequisite for momentum. Buyers stall when they’re uncertain; unsure who to trust or what decision to make. They second-guess listings, advice, and even themselves. That uncertainty slows down decisions, erodes loyalty, and adds cost across the value chain.

Every loan costs lenders 35% more to originate than in 2020. Administrative and operational costs along with the price of digital tools have pushed costs up to nearly $12,000 per loan, according to Freddie Mac. And when 30% of mortgage applications never make it through to sale, not all those associated expenses are recuperated, Mortgage Brokers Association data from the first quarter of 2025 found. That figure will only grow as complexity increases; it has already risen from 24% in 2021. Reducing that loss begins with understanding.

Speed has become the goal. But faster systems don’t always bring clarity. A rushed process can leave people with more decisions, not fewer — and less confidence in the ones they make.

Without a doubt, agents remain part of the system, but there is evidence that their role is under pressure. The agent count has risen over the last 10 years, even as housing supply stagnates. Margins are tighter. Relationships are finite, with 73% of those surveyed by Cotality saying they did a lot of their own research rather than primarily relying on professionals. Some agents are carving out niches. Others are partnering with tech platforms. But some still struggle to define their value, adding to a market crowded with undifferentiated choices.

Agents, redefined

This doesn’t mean agents are obsolete. It means the model is shifting them to a more nuanced way to add value.

“Technology and AI — that's this new scary thing that people don't want to really dive into to learn,” Savanna Pearson from Smith & Associates Real Estate told Cotality. “But it reshapes the way that agents can work and run their own business.”

Agents who learn to harness these tools will thrive in an industry that’s rapidly evolving — one where their role is shifting from gatekeeper to trusted advisor, bringing deeper, more meaningful value to homebuyers.

Kevin Greene, General Manager of Real Estate Solutions at Cotality highlights the importance of looking ahead for agents. “The value of an agent today lies in their ability to serve as a truly informed advisor — someone who can distill complex property data and translate it into actionable insights tailored to each client’s unique goals. Agents provide the context needed to navigate what can often be conflicting or overwhelming information,” he says.

Purchasing property is complex. The agents who thrive will do more than open doors, they’ll bring context. They’ll answer the critical question, ‘why this home, not that one.’ That requires data. Not raw feeds, but interpreted signals that help them anticipate risk, explain outcomes, and tailor options in real time.

The data shows that homebuyers are looking for agents to become partners. In Cotality’s House to Home survey, 75% of recent homebuyers said they were likely to work with the same person again. The reason? Trust.

Greene explains that the most valuable context for homebuyers comes from a blend of property data and agent insight. “An algorithm won’t understand why a buyer might prefer a certain street because their sister lives nearby. That’s the kind of human understanding only an agent can offer,” he says. “But technology is a powerful tool that helps agents round out their understanding of a property, equipping them with a more complete picture — quickly, accurately, and with greater ease.”

Accelerating trust in AI

The future isn’t a binary choice between digital or human. It’s hybrid. The strongest tools blend digital tools with human judgment. Buyers want fast answers, but also someone who can explain the trade-offs. They trust platforms to surface issues but still rely on people to help solve them.

“There are so many moving parts that are integral to making a closing happen. There’s a lot going on, and I'm kind of the ringleader,” Jane Spann, a real estate agent in Virginia told Cotality. “There will still be that need for the human touch.”

But what can be done? Well, that’s the opportunity. MLS organizations and brokerages that blend technical precision with human guidance will create more opportunity, faster paths to close, and more confident decisions — the kind that stick. That’s good for buyers, yes. But also for lenders, insurers, platforms, and agents themselves.

By modeling buyer behavior, mapping risk triggers, and building tools that empower real estate professionals at every touchpoint, Cotality has been examining how to make it easier to buy homes with speed and certainty. There is no longer a distinct division in the roles of humans and technology. The best results come from using both, in concert.

Agents who understand that will reinvent the process.

The agent squeeze: More players, less power

.svg)

Real estate agents were once the unquestioned leader of the homebuying process. Now they sit at a crowded table — still important, still visible, but with less room to move and add value.

Agents are now chasing to fewer leads and listings in a market burdened by high price tags, an insufficient number of homes, and people staying in place longer. Buyers come armed with online research and automated alerts. Sellers also want speedier processes and more guarantees. And yet, despite all this, some agents still operate as if nothing’s changed.

Things have changed. In the last 10 years, the number of registered real estate agents in the U.S. rose by just over 500,000 agents, but the number of homes sold across the country dropped by about 290,000 homes, according to Cotality data. There has been a similarly steep rise in the number of Australian real estate agents, but like the U.S., Cotality analysis found that home sales haven’t kept up with the growth in the number of agents. Compared to 10 years ago, Australian home sales only increased by about 17,000 units. In the U.K., there was also a slight uptick in the number of agents between 2018 and 2024, while the number of home sales in England dropped by 384,000 homes during the same period.

The profession is fragmenting. At one end are top-performing agents leaning on data tools, sophisticated marketing, segmentation models, and specialist expertise to gain more leads and listings. At the other, are the generalists fighting to retain relevance. The average agent sits somewhere in between — stretched thin, digitally outpaced, and commercially exposed.

“Agents and agencies aren’t short on connections or clients. What’s often missing is the nurturing process and the data that reveals the full story through contextual understanding of client and vendor needs,” says Michael Buckland, Director, Sales - Real Estate at Cotality Australia and New Zealand.

Don’t mistake speed for value

Part of the problem may be positioning. Too many agents sell themselves on traditional offerings — local knowledge, responsiveness, and human touch — without acknowledging that platforms can offer a similar service, and usually quicker. What can’t be replicated is the lived experience and discernment that can better guide the buyer. But not all agents recognize the importance of being a well-informed advisor as a part of a buyer’s hierarchy of needs.

“Clients don’t need another person to just curate more listings. What they want — and need — is more context around each listing: Why this house? Why now? What don’t I understand in terms of potential upsides or downsides,” says Kevin Greene, General Manager of Real Estate Solutions at Cotality.

That shift — from being the source of listings to the interpreter of risk and reward — is key. It’s also underdeveloped in many agents.

The agents who retain loyalty aren’t always the ones who close the fastest. They’re the ones who highlight the unseen in the process and advise buyers to course correct or consider what data signals mean to them. That means anticipating how to make the most successful offers. Helping buyers navigate affordability constraints. Understanding financing limitations. Knowing when insurance or lending terms might kill the deal before it begins.

Agents who flag pitfalls early and can connect buyers to the right experts throughout the process increase the number of deals that make it to close. They also improve their chances of creating extended relationships and more referrals; a full 45% of buyers expected their real estate agent to guide them through the process end-to-end, a Cotality survey found.

Top expectations of recent homebuyers

The tools for this already exist. But few agents are trained to use them — and fewer still are supported to make them central to their approach. Brokerages reward volume. Platforms reward speed. But neither necessarily showcases the kind of expertise that builds trust before the contract is signed.

Clarity cuts through

This is where the opportunity lies. The value comes from providing trusted insight that helps agents better guide clients, not from piling on similar tools for already overwhelmed agents. A full third of those surveyed recently by Cotality rated trust as the most important criteria when finding and buying a home. That could mean making real-time data on shifting market patterns. Flagging insurance gaps before viewings happen. Or matching mortgage indicators based on live lender criteria, not generic filters.

In this environment, the advantage goes to those who move early — with speed, accuracy, and confidence. That’s what Cotality sees in its data and through its CoreAI tools: sharper signals, fewer delays, more productive outcomes — an essential recipe for future agent success.

When agents are armed with tools that can show buyers a listing that meets their criteria and layers on answers to the questions they didn’t know to ask, it keep buyers more engaged and active. Similarly, when they can connect listings and potential homeownership costs to show variability in monthly payments, buyers spend over 5 minutes actively engaged.

However, technology must be guided. While only 27% of the people Cotality surveyed expected technology to play a very beneficial role in the process, 76% agreed their agent provided valuable guidance. If agents can integrate the foresight that technology provides into their interactions, they can solidify their place in the homebuying process through trust.

The agent squeeze is real — a real opportunity. For those who adapt, this is less a loss of power and more a redefinition of it.

Lenders in the lead

.svg)

Most prospective homebuyers start with the basics — a credit check, a rough budget, a sense of what’s possible. That hasn’t changed. What has changed is how they get those answers.

Rates shift daily. Listings move quickly. And younger buyers often face older, wealthier competition. That pressure is pushing more people to use tech tools that can tell them — fast — if they’re likely to qualify.

In Cotality's From House to Home survey, only about a third of respondents said they would work exclusively with a person to find a mortgage. The rest looked to AI technologies for a helping hand in a process that 41% say needs to move faster.

However, the data shows that the answer to how much home one can buy doesn’t only need to be faster; those answers need to come earlier. And buyers need to trust that there won’t be dramatic changes during the loan process.

Financial backing early in the process can certainly help ease some of the pressure that comes with buying a home. Nearly 60% of Millennial and Gen Z buyers say they feel overwhelmed by the idea of finding a mortgage — a sentiment that reflects how their expectations can clash with traditional lending models.

Mortgage qualification remains complex for the uninitiated. Lenders are, understandably, applying stricter criteria, but more flexible options are also emerging. Helpfully, these alternative models are opening new routes to ownership, especially for younger buyers who are less likely to put down a 20% deposit.

What are these more flexible models? Shared equity. Fractional stakes. Co-buying. Supplemental freelance income. Institutional ownership. These options can open the door to more buyers, but they also add pressure to already limited inventory. And while interest is growing, many lenders still aren’t set up to assess income or eligibility for non-traditional applications.

Cotality found that buyers with incomes under $50,000 are over twice as likely to have their application for a 30-year, fixed-rate denied as compared to buyers with incomes over $100,000. But these more traditional mortgages don’t always consider alternative sources of income or unconventional financing, which could artificially limit lenders’ pools of qualified potential buyers.

Breaking with tradition isn’t necessarily right or wrong, but it is a change that the entire industry needs to prepare to manage. Adaptation, while rarely easy, will build the foundation for lenders to support future generations of buyers.

Cotality is tracking how lending terms now influence demand as much as price. The data shows where buyers qualify, where they stall, and how models shift behavior long before the offer stage.

In 2024, Cotality found that 16% of loan applications were withdrawn by buyers. There are many reasons for this. But one recurring reason is confusion.

“I felt confused because some of the closing costs weren’t what was originally advertised,” said one Gen Z buyer in Cotality’s From House to Home survey.

This confusion may be partially due to lack of guidance, the kind that comes with a mortgage broker or trusted direct lender. Only 30% of future Gen Z buyers said they were likely to work with a mortgage broker, but 73% revealed that they have a preference to have a person involved alongside technology when they are looking for a mortgage.

Why? Because, according to Cotality findings, trust is the second-most important criterion for buyers, after price.

“I would feel a lot more confident if I had a professional right there guiding me to the right path when making a decision for my mortgage,” said one Gen Z respondent who is planning to buy a home soon.

When it comes to getting a mortgage, there are clear signals indicating a need for both speed and guidance. Today’s lenders are serving a new generation of buyers with unconventional constraints and helping create new pathways to homeownership. The professionals who are able to offer workflows that accelerate the mortgage process, and provide clarity along the way, stand to become the model that others will follow. Investing in better technology and responding to how homeownership is changing can help reshape the housing system, making it stronger, fairer, and more sustainable for everyone involved.

Finding the sweet spot between insurable and affordable

.svg)

The road to homeownership seems clear until insurance causes a bump in the road. A buyer might have pre-approval, funds, and intent. But higher premiums, a lack of current data, or shifting terms can stop a homebuyer — and a deal — abruptly.

Despite the continued need for people to verify more complex applications, consumers’ expectations are changing alongside the risk landscape. Just over half of those surveyed by Cotality said they would trust AI equally, if not more, than a person to find insurance options. Over 60% of respondents said using an AI tool to find a policy is more convenient than interacting with a person.

The takeaway feels like so many things in life: people are looking for the most convenient options available.

In the same survey, Cotality found that Gen Z is tracking insurance particularly closely. Nearly three-quarters of Gen Z respondents said that the availability of insurance will influence the timing of when they buy a home.

Providing the coverage buyers need begins by understanding the map of risk. Just like homebuyers, insurers need tools that can pinpoint the risk profiles of individual properties because no two structures are created equal.

Every home is unique thanks to a combination of location and mitigation. Elevated first floor heights can help a home survive a flood. So can a hill. Defensible space around the perimeter of a home increases the likelihood of surviving a fire. So does natural vegetation. Roof type will determine the final bill following a hailstorm. So too will storm corridors.

If insurers blanket their policy decisions rather than understanding risk at an individual property level, they risk leaving business on the table.

Insurance companies are working quickly and intelligently through dynamic and high-pressure circumstances to figure out where they can support homebuyers by providing policies in areas that may be overlooked by others. Those who are successful are recalibrating using forward-looking environmental models and risk scores to determine not just what they cover, but where.

“Risk is expanding, but not always in predictable ways. That is causing homeowners to find themselves in situations where policies are not renewable, or the insurance policy costs have increased to an unaffordable level and then they're stuck with a house they can't sell,” said Cotality’s Chief Scientist Howard Botts. “We are seeing in some coastal areas in Florida that if you haven’t elevated your home — which can cost well over $100,000 — or in California where traditional insurers aren’t renewing policies in high-risk wildfire areas, it’s having an impact on the real estate market.”

Cotality data shows that policyholders who take the proper mitigation measures to strengthen their properties pay lower premiums on average. Similarly, a lack of mitigation on hazard-prone property can lead to difficulties in obtaining insurance.

In 2024, real estate agents lost 13% of their deals in California, due to a lack of insurance, according to the California Association of Realtors. That's twice what was reported in 2023. And in more and more regions, coverage is disrupting deals. The buyer often only learns about these limitations too late, when the process limits alternatives.

“What surprised me the most was the homeowners’ insurance plans where there is not a lot of coverage,” said a Gen Z survey respondent.

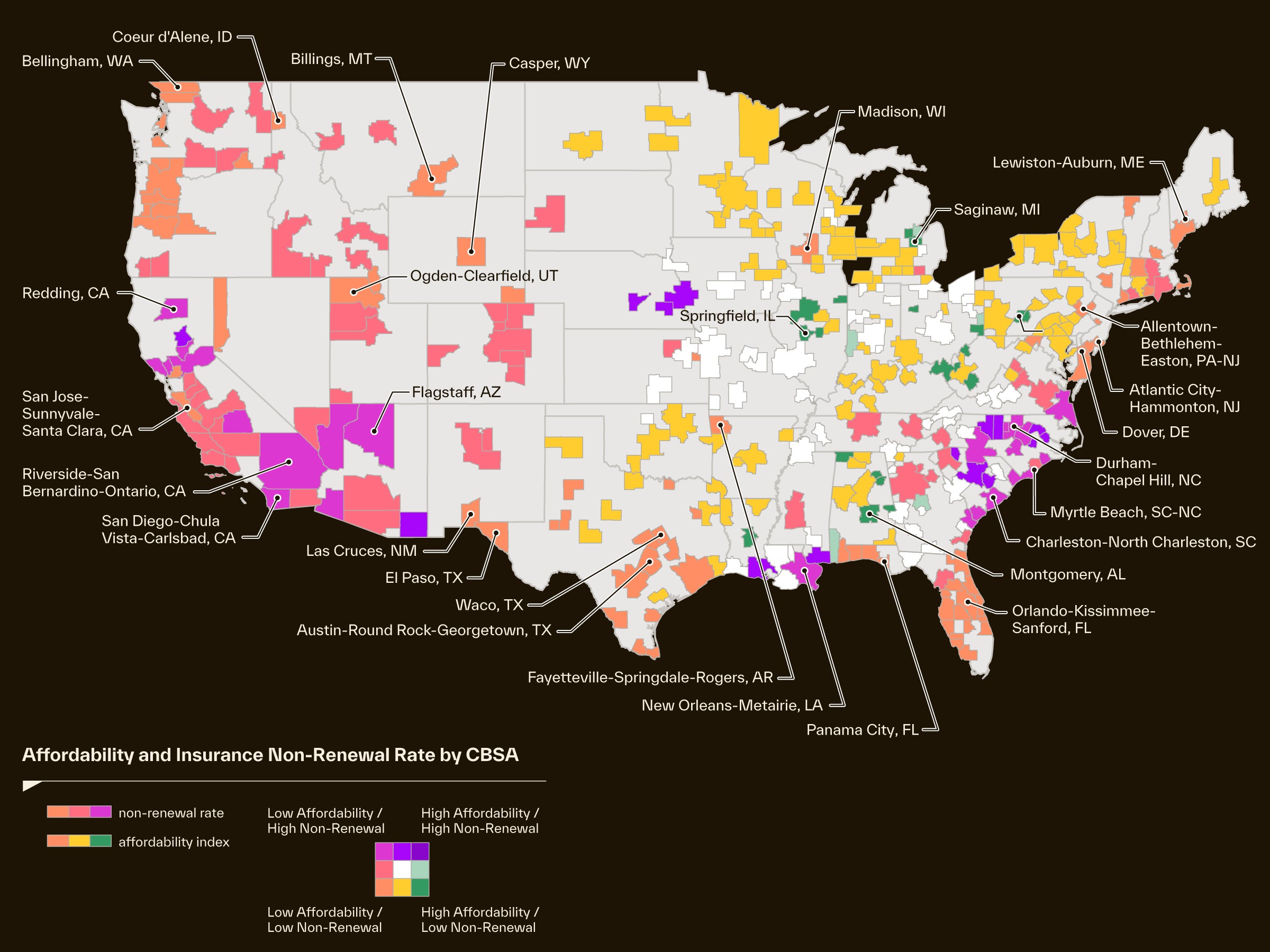

Where does insurance and home affordability coincide?

Data source: Cotality, 2025

But this trend is not inevitable.

Affordability must now account for both price and risk. Expert analysis of future risk will be key. Without understanding how the environment will evolve, insurers will box themselves into a portfolio of policies that can leave them financially vulnerable to any change. They will also miss millions of homes that are insurable.

Rather than relying on underwriting policies that view risk at scale, it pays to pay attention to a combination of mitigation and precise location. Data makes it easy. See the difference between properties so that business doesn’t get left on the table and homeowners don’t get left behind. Designing a future-proof portfolio means more room to increase policies for future homebuyers.

The rules of insurance are shifting, and the risk is rising

.svg)

Regulation shapes where homes are built, how loans are issued, and which risks can be insured. But as environmental volatility grows, long-standing protections are starting to slip.

For some homeowners, insurance is no longer available or affordable. Buyers take on more of the risk themselves, while public systems strain to keep pace. Private insurers are scaling back.

The impact runs deeper than individual policies. When coverage gaps grow, the foundation of the property market becomes less stable — and harder to protect.

Peril risk's influence on rebuild costs in 15 large U.S. cities

Data source: Cotality, 2025

What’s less apparent is how a smaller safety net has the potential to erode the foundation of the property market.

“It’s becoming critical for both mortgage bankers and homebuyers to understand whether a home is adequately insured against natural hazards,” said Pete Carroll, EVP of Public Policy and Industry Relations at Cotality, "Because this dynamic is increasingly determining whether the mortgage remains sustainable or ends in serious delinquency."

Where premiums pinch

Asheville, North Carolina shows how quickly risk can ripple through the market. In March 2025, Cotality data revealed that mortgage delinquencies in the city — still recovering from Hurricane Helene in 2024 — had risen 1% year over year.

That’s often the beginning of a longer strain. After a disaster, insurance terms may shift. Premiums rise, raising the overall cost of a mortgage. For some homeowners, those higher payments create pressure that lasts for the life of the loan.

Property risk is sometimes difficult to pin down. There’s no fixed rule for what makes a home insurable. Two streets apart, terms can vary widely. And buyers don’t always discover that until they’re already committed to buying.

Even before a purchase, insurance pricing plays a central role. In Cotality’s From House to Home survey of people across the U.S., 40% named cost as the most important factor in their decision. But those prices are often shaped by state-level rules. To find the best deal, 41% said they would turn to AI — more than in any other stage of the homebuying process — because it’s fast and convenient.

That trend towards using AI in the insurance buying process comes with risk. When buyers depend on AI to guide complex financial decisions, the burden of accuracy shifts to the individual. If the policy turns out to be a poor fit, there may be limited room for recourse.

“In some states, insurance regulations make it difficult for insurers to accurately price growing natural disaster risks and homebuyer migration into hazard-prone areas. This can lead to cross-subsidization, where homeowners in lower-risk states help cover costs in higher-risk ones.” — Pete Carroll, EVP of Public Policy and Industry Relations at Cotality.

Cotality’s data shows the cost of insurance-mortgage mismatches — and what’s at stake when risk moves downstream.

In 2024, Florida, South Carolina, and Georgia saw some of the biggest jumps in serious mortgage delinquencies. They also saw some of the sharpest changes in insurance, both in availability and cost, according to Cotality data.

“While Florida’s metros have topped the list of hottest appreciating housing markets in recent years, the increasing costs of persistent natural disasters, and consequent pressure on insurance expenses, and rebuilding costs are starting to weigh on home prices in west Florida,” Cotality’s Chief Economist Dr. Selma Hepp explains. “The Cape Coral region, for example, was one of the few markets last year where home prices declined as a result of these issues.”

Down Under difficulties

In Australia, migration to the Sunshine and Gold Coasts has gained momentum over the last couple of years. Within the last five years, insurance claims from catastrophic events have risen by nearly 50%, according to the Insurance Council of Australia. Most of these claims are from flooding. Cotality’s models show that the highest concentration of properties with ‘Very High’ risk rates are along these same coastlines that people flock to. This means that when a storm passes through, even if the damage isn’t widespread, it may add a hefty price tag.

Mother Nature is pushing premiums to new limits in Australia. In response to this developing crisis, the federal government established the National Emergency Management Agency (NEMA) in 2022 to aid those affected by these accelerating natural disasters.

But the risk in these typically low-lying areas is only growing alongside homeowners’ insurance premiums. A self-fulfilling cycle attracts buyers to cheaper exposed properties, who are the least able to recover from catastrophic climate events. The government is often left to try and pick up the pieces.

Floods and storm damage are not the only drivers of higher premiums. Wildfire risk is also rising, but better policies that adapt and encourage mitigation may ultimately change homeowner outcomes. “The next generation of insurance is going to be based on fire hardening and fire mitigation,” Robert Feldman, WOWs Fire Insurance Services CEO and co-founder told Cotality. “By doing so, we can aggressively lower risk, and that’s the direction the industry needs to go to help correct the oversaturation and lack of mitigation.”

Without this ability to see the future of risk, structural change will be slow, and buyers may pay the price — whether they know it or not.

Understanding the housing trust gap

.svg)

Every tool claims to improve the property journey. Few explain how.

Homebuyers are surrounded by systems. Listings recommend. Lenders validate. Agents advise. Platforms track. None are speaking to each other. At least not often enough for homebuyers.

Cotality’s research shows the cost. Confidence falls. Transactions slow. Contract dropouts rise.

In Cotality’s recent From House to Home survey of recent and prospective homebuyers in the U.S., Cotality found only 27% of recent homebuyers expected technology’s role in the journey to homeownership to be very beneficial. Most rely on industry professionals to help bridge the gaps between steps in the homebuying process.

At the same time, buyers still encounter complications when relying on humans for help. In the From House to Home survey, 41% said they experienced unexpected delays and issues, which they attributed to the professionals that they worked with throughout the homebuying process.

It’s a heavy lift, especially for younger buyers. Over half (59%) of Gen Z homebuyers say the process of finding a home feels overwhelming. But it shouldn’t require jumping between professionals and hoping it all holds together by the end. Buyers want to feel guided. In Cotality’s survey, one third of respondents said trust was the most important factor when choosing a home, a mortgage, an insurance policy, or legal support. They also value speed and convenience. But these needs are often hard to meet at the same time.

Cotality is mapping where the process breaks down. By analyzing transaction timelines and identifying the points where deals slow or stall, we can isolate sources of friction and address them early.

It starts with history. Every property has a record: application updates, valuations, interactions between buyers, sellers, and intermediaries. But that’s only part of the picture. Past activity needs to connect with current requirements and anticipate potential obstacles.

Will future environmental conditions make a home uninsurable? Are neighborhood shifts likely to affect buyer confidence? Is the valuation based on sound data?

Each piece matters. When brought together, they provide structure to a process that often feels fragmented. Better sequencing leads to fewer blind spots. Earlier signals make it easier to navigate decisions. Buyers don’t expect a flawless experience. But they do want fewer surprises.

This is where technology and human expertise work best in combination. Many buyers already trust AI to help find homes or assess mortgage options. That trust remains consistent across age groups. What’s still needed is confidence. Buyers want to know what comes next, and they want someone to help them get there.

Opportunity knocks

These buyer expectations represent opportunity.

People expect to see what’s coming next in a process. From real-time delivery tracking to progress bars indicating the length of a form-fill, people are used to knowing what to expect in other parts of their lives. They are also accustomed to systems that are simple to use. If industry professionals can provide a seamless experience that guides buyers between handoffs, they will stand out in an increasingly crowded and competitive landscape.

Trust will return. But only when systems stop competing for control and start coordinating for clarity.

The real estate guide, redefined

.svg)

Plenty of property market professionals interact with the homebuyer. Fewer take responsibility for their experience from start to finish.

A Cotality assessment of the real estate market has determined that today’s most effective industry professionals act as guides through a system that’s grown more complex at every step. They explain what’s coming, flag what might cause delays, and help buyers make decisions with full context.

This kind of support requires access to timely data, the ability to interpret risk, and the judgement to act when patterns start to shift.

Technology helps surface the signals. But it’s the industry experts who give those signals meaning.

Real guidance is informed, proactive, and aligned with the buyer from first step to final signature.

“The challenge with homebuying is that it’s not something that most people do very often,” says Cotality’s Chief Data & Analytics Officer John Rogers. “So, by wrapping technology with human guidance, we can offset the lack of familiarity with trust because these professionals are familiar with the data and systems, allowing them to signal potential pitfalls or opportunities to help buyers make the right decisions.”

Fast systems, steady hands

In the recent From House to Home survey, future U.S homebuyers told Cotality they need this type of guidance in an industry that is accelerating its dependence on technology solutions. Almost half of those surveyed said that while technology is increasingly expected, and integral, they still prefer to work with people.

“The answers (in the homebuying process) were technical and came at you fast, so it was incredibly reassuring to have guidance when you asked,” said a first-time homebuyer from Boston. “The highlight of buying a home was having a team where everyone knew each other's processes, so when something had to be done behind the scenes, they easily took care of it.”

Cotality regularly analyzes how combining data with human expertise delivers results.

One tool flags issues that could disqualify a buyer from a mortgage. Another allows agents to connect buyers to listings based on their preferences, while also linking them to insurance options and mortgage offers. A risk model goes further by recommending policies that match the buyer’s full profile, not just the property.

“Data breeds knowledge. Knowledge leads you to making good decisions,” explains Stanley C. Middleman, the founder and CEO of Freedom Mortgage. “And if you can make good decisions, you're going to have successful customers, and those customers are going to do more business with you.”

The future is curated. Not by gatekeepers, but by guides with access to every signal the buyer needs, and few of the incentives that distort them.

The buyer still holds the decision. But the journey improves when someone draws the map.

.svg)

.svg)

.svg)