DigitalTax® Forecasting Insights

Spot potential shortages in your portfolio

Stay ahead of escrow surprises

Property taxes rose by more than 15% on average across the U.S. last year - putting many homeowners at risk of potential escrow shortages.

Our tax amount forecasting tool flips the script. Instead of reacting to surprises, you’ll anticipate them. Identify potential shortfalls by county and plan with precision so you can manage property tax payments and secure funding sooner.

Local governments benefit too - using the same insights to predict property tax increases and improve property tax planning and revenue forecasting.

Say goodbye to outdated estimates. Say hello to proactive, data-driven planning.

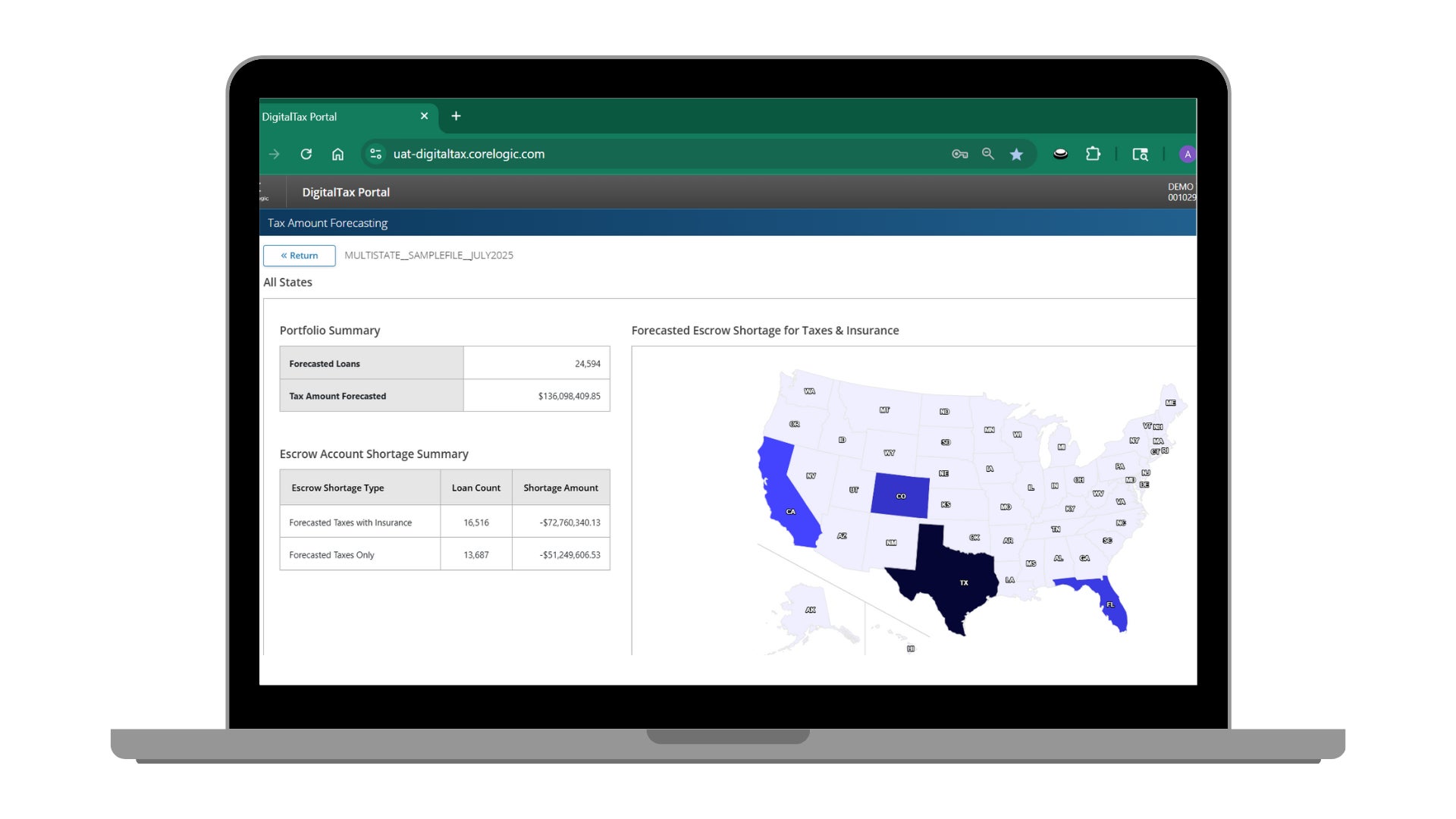

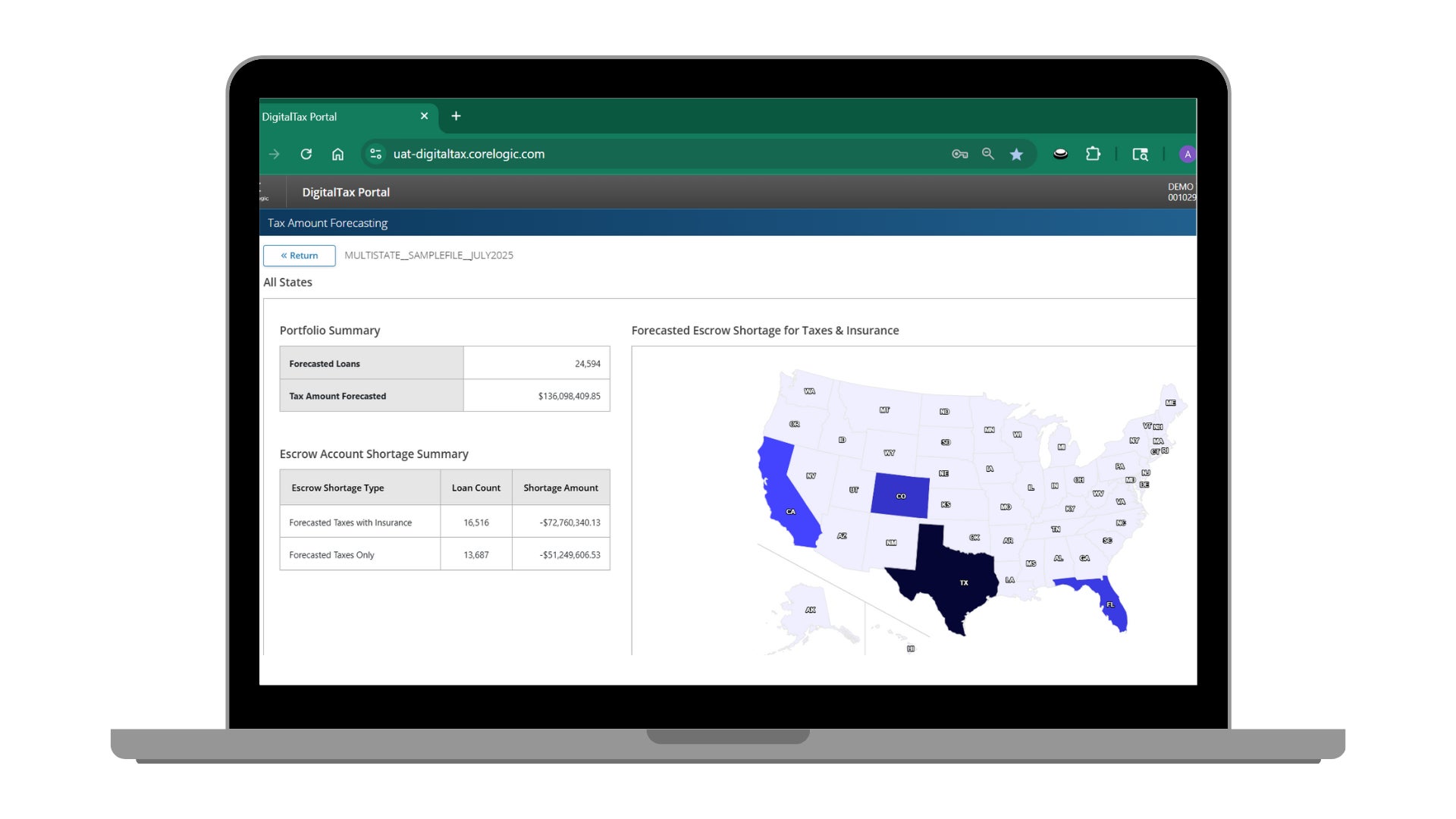

Forecasting at a glance

An interactive dashboard helps you quickly spot potential property tax increases right from within DigitalTax Portal. Powered by advanced modeling, you can forecast risk, plan ahead, and proactively support homeowners before surprises arise.

Advanced patent-pending forecasting model

Our model, powered by 5.5 billion US property records, helps you assess future escrow shortage amounts accurately, right down to the county level.

Cutting-edge dashboards for informed planning

Quickly see which states and counties face escrow shortfalls, uncover trends, and spot challenges—so you can act early and confidently plan the best path forward.

Advanced patent-pending forecasting model

Our model, powered by 5.5 billion US property records, helps you assess future escrow shortage amounts accurately, right down to the county level.

Cutting-edge dashboards for informed planning

Quickly see which states and counties face escrow shortfalls, uncover trends, and spot challenges—so you can act early and confidently plan the best path forward.

FAQ

Who is eligible to use DigitalTax Forecasting Insights?

This solution is available for tax clients who need to forecast future property tax amounts. Currently, a group of clients are trying it out in our Early Access program. If you're interested in joining the waitlist, fill out our form.

Does the model account for exemptions?

Yes, our patent-pending model takes into account any known exemptions and applies them to the forecasted amounts returned.

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.

Trying to reach us by phone?

Get in touch with our sales team at (866) 774-3282. We're here Monday to Friday from 7 a.m. to 5 p.m. CT.

Looking for support?

Visit our dedicated support page to find support for all our products.

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.

Trying to reach us by phone?

Get in touch with our sales team at (866) 774-3282. We're here Monday to Friday from 7 a.m. to 5 p.m. CT.

Looking for support?

Visit the Cotality Credco resource center, your dedicated hub for product documentation, training, and support.