Press Release

Cotality: Single-family rent prices continued upward trend in May

U.S. single-family rent prices increased 3.1% year over year in May 2025.

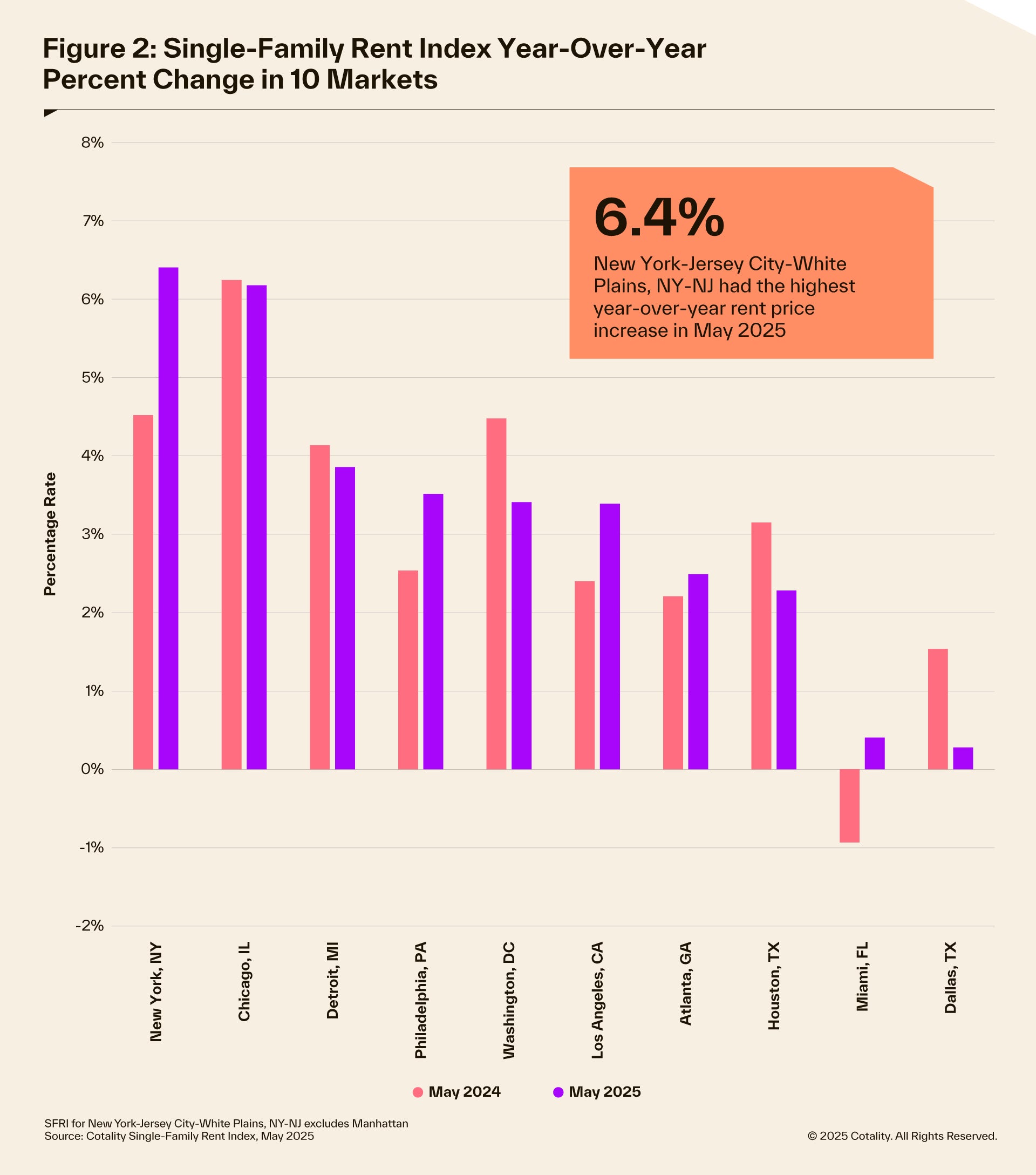

- New York had the highest year-over-year rent price increase at 6.4% in May 2025.

- Los Angeles fell to the sixth-highest rent growth out of the largest 10 metro areas following the dissipation in demand from the January wildfires.

- Dallas single-family rents increased year over year in May, reversing a trend from the prior two months.

IRVINE, Calif., June 17, 2025 — Cotality, a leading global property information, analytics, and data-enabled solutions provider, released its latest Single-Family Rent Index (SFRI) for May 2025, which analyzes single-family rent price changes nationally and across major metropolitan areas. Single-family rent prices in May 2025 increased 1.1% from the previous month, faster than the 0.9% increase last year and closer to the average May change before the pandemic.

Compared to last May, rents increased by 3.1%, compared to 3% in May 2024. This trend continues from the past few months as prices return to pre-pandemic rates of growth at 3.4%.

"Annual single-family rent growth accelerated in May for the fourth consecutive month, signaling sustained momentum in the rental market. While rent growth increases have been gradual, they stand in stark contrast to the cooling trend in home price growth, which has been slowing throughout 2025,” said Molly Boesel, Cotality senior principal economist. “This divergence isn’t surprising — many would-be buyers, deterred by elevated home prices and interest rates, are staying in the rental market, driving up demand. Monthly gains in the single-family rent index have consistently outpaced seasonal norms this year, suggesting that annual rent growth for 2025 is on track to exceed 3%."

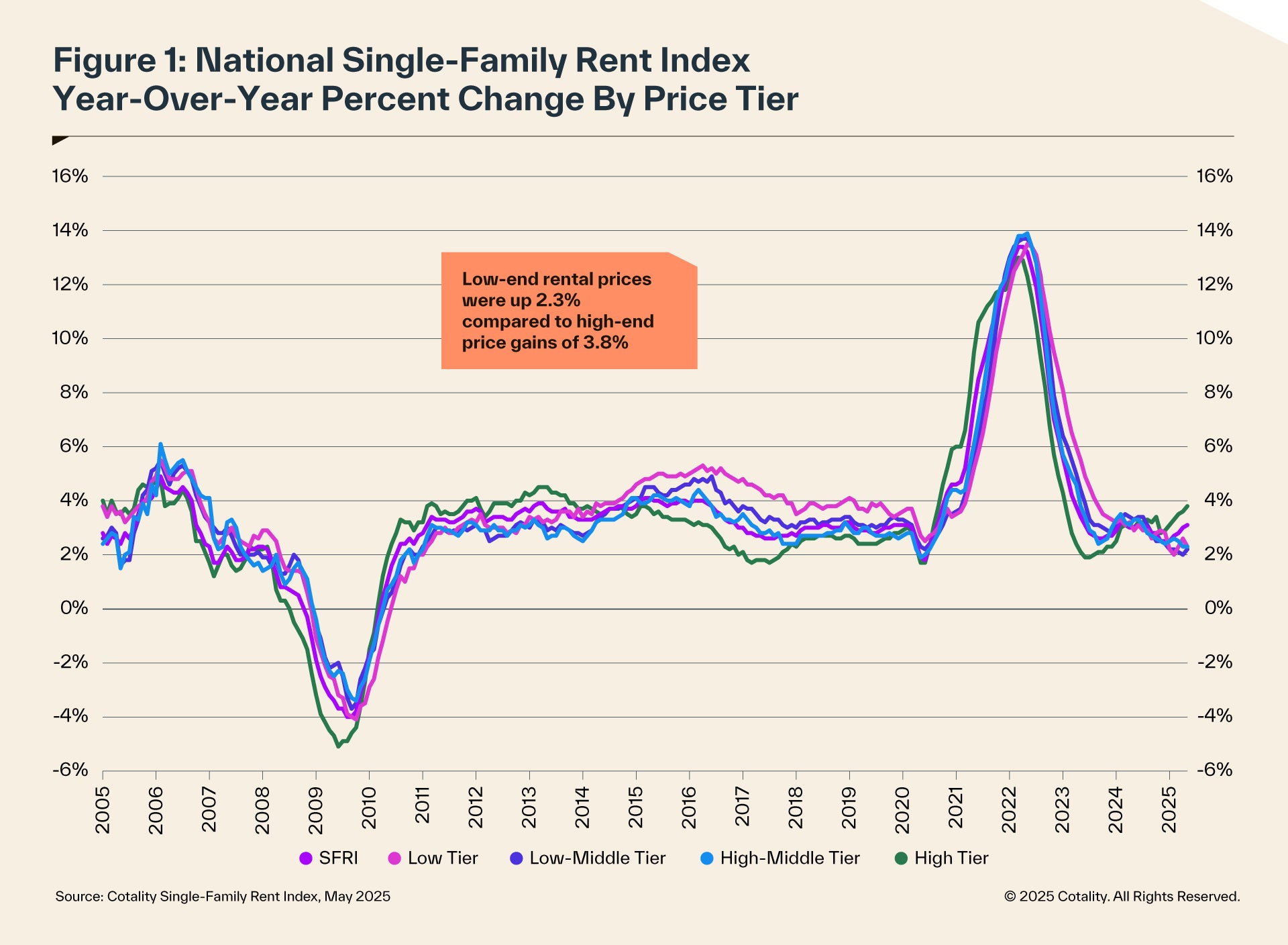

Rent prices for high-end properties increased 3.8% year over year in May 2025, a pickup from the year-over-year gain of 3% in May 2024. Low-end rent prices increased 2.3% year over year in May 2025, a decrease from the 2.9% gain in May 2024.

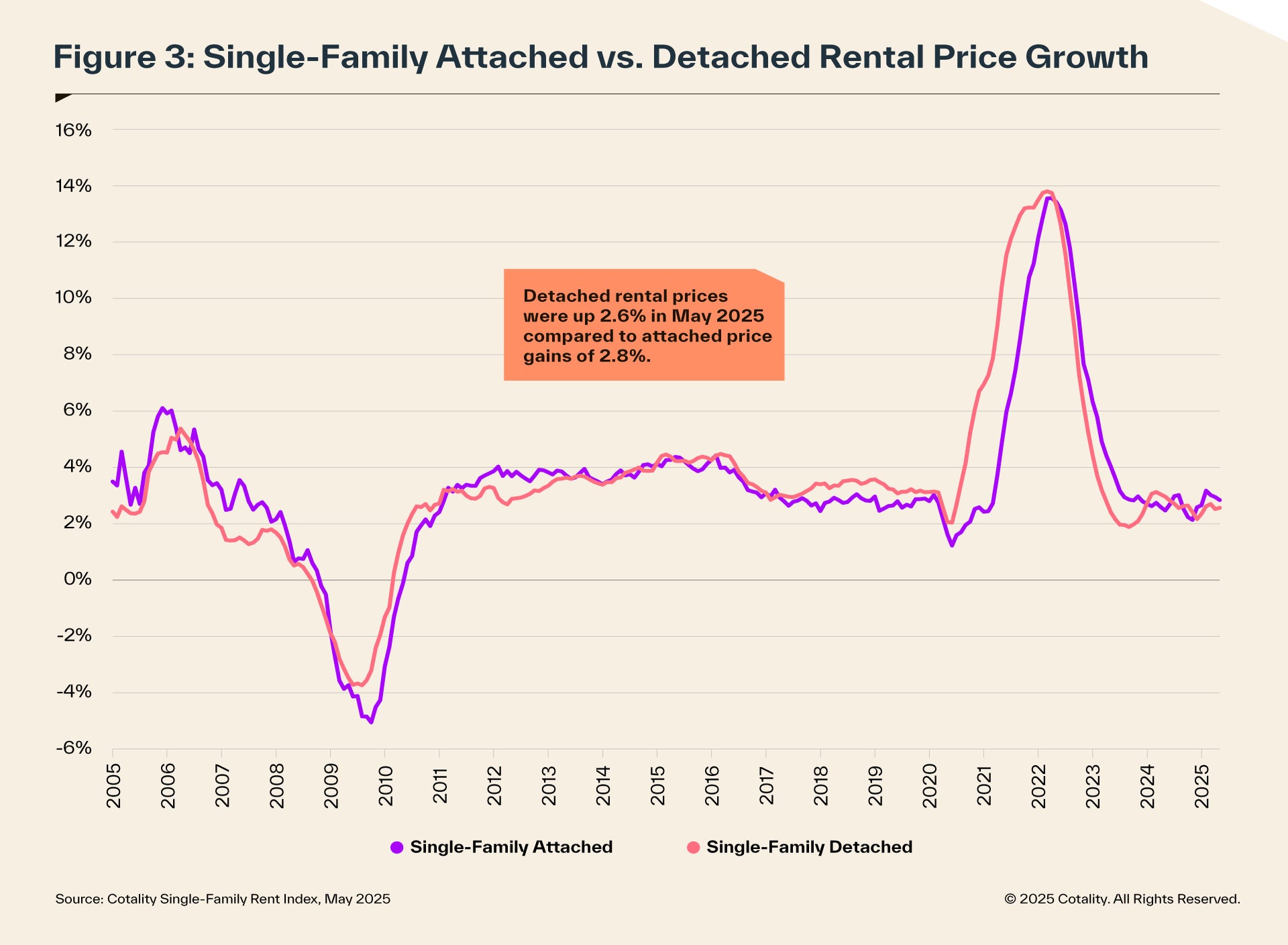

Rent for detached rentals grew by 2.6%, and attached rental rates rose by 2.8% in May 2025.

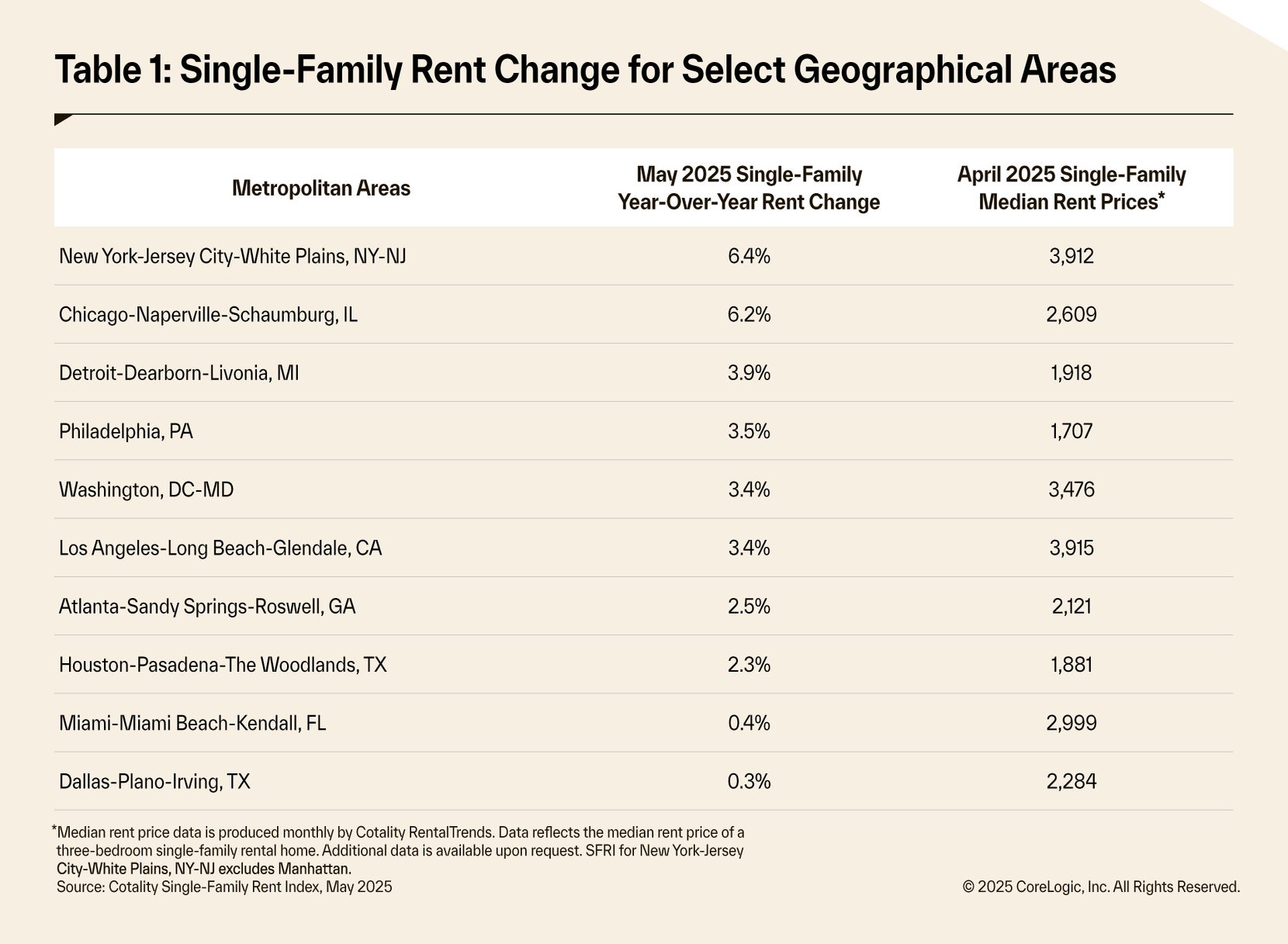

New York-Jersey City-White Plains, NY-NJ saw the highest rent growth, moving to the top of the SFRI at 6.4% in May 2025. It was followed closely by Chicago at 6.2%. Los Angeles dropped to the sixth spot as the impact of the January wildfires dissipates. Dallas continues to have the lowest rent growth in the nation, posting 0.3% in May. The index shows a decrease in rents for attached rentals in Dallas, while it shows an increase in rents for dettached rentals as attached rentals compete with the increased supply of multifamily rentals in that metro.

The next Cotality Single-Family Rent Index will be released on August 21, featuring data for June 2025. For ongoing housing trends and data, visit the Cotality Insights blog: www.cotality.com/insights.

Methodology

The Cotality Single-Family Rent Index (SFRI) applies a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. The rental listings used to calculate the index include both attached and detached single-family homes, as well as condominiums. This report shows trends for the U.S. and the largest 10 U.S. metropolitan areas. In addition to these 10 metros, the Cotality SFRI is available for close to 100 metropolitan areas — including approximately 50 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The Cotality Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by Cotality Rental Trends. Rental Trends is built on a database of more than 11 million rental properties (over 75% of all U.S. individually owned rental properties) and covers all 50 states and 17,500 ZIP codes.

About Cotality

Cotality accelerates data, insights, and workflows across the property ecosystem to enable industry professionals to surpass their ambitions and impact society. With billions of real-time data signals across the life cycle of a property, we unearth hidden risks and transformative opportunities for agents, lenders, carriers, and innovators. Get to know us at www.cotality.com.

Media Contact

Charity Head

Cotality