Press Release

10 things to know about the property market: September 2025

IRVINE, Calif., September 25, 2025 — Cotality, a leading global property information, analytics, and data-enabled solutions provider, released its latest list on the 10 things to know about the property market for September 2025.

Despite the chill that pervaded the housing market this summer, market trends shifts may be laying a new trajectory for the fall.

Conditions are gradually shifting in favor of buyers as inventory grows. Some cities, particularly in the Midwest and Northeast where migration is attracting newcomers, are seeing solid price gains. However, other areas of the U.S. are seeing a slowdown in prices. For everyone, affordability remains a major challenge.

Sellers across the country are choosing to pull their homes off the market as listings linger longer and fewer homes sell. Homes that do sell are often bought by investors who make up a significant share of single-family purchases thanks to their ability to pay cash and avoid high interest rates. Still, slow price growth is encouraging investors to hold properties longer, fueling the trend of converting homes into rentals to meet strong leasing demand. Despite high demand for rentals, rent growth is softening.

For homeowners escrow costs are rising, equity gains are slowing, and many remain locked into low-rate mortgages, which is limiting overall market movement.

U.S. housing market trends

- The number of listings sold from January to July in 2025 was 4% below the same period in 2024. Although the year-to-date increase in for-sale inventory is about 26%, the number of delisted properties rose in the first half of 2025 and listings are taking about five days longer to sell on average. Why? Affordability remains an obstacle for many.

- So far this year, investors accounted for 30% of single-family home purchases, which is higher than the 27% average from 2024. While investors face the same high home prices as owner-occupants, many are insulated from elevated interest rates by paying in cash. After purchase, they can recoup some of the cost by raising rents since home-buying affordability challenges are driving strong demand in the rental market. As of mid-2025, only 7% of investor sales were homes purchased within the past year. This is down from 14% at the same time last year. Slower home price appreciation is shifting investor strategy away from flipping and toward holding properties as rentals.

- Home price appreciation continues to slow nationally, with Cotality’s HPI registering a 1.4% annual increase in July and a monthly decline of 0.2%. And while some 20% of markets have seen home prices decline year over year, the majority of markets are still seeing positive gains. Among the largest metros, the strongest price gains this summer were in markets in Midwest and Northeast. Pittsburgh was up 2.8% from April to July, Cleveland prices gained 2.8%, Buffalo recorded a 2.6% increase, Chicago price tags rose 2.4%, and Camden, NJ; Milwaukee; and Indianapolis all saw prices up by 2.4%

- Home prices remain robust in areas where migration accelerated in 2024 as compared with 2019. New York and Illinois have the largest increase in net migration as well as some of the strongest year-over-year home price growth. By contrast Florida, Arizona, Texas, and Washington had the largest slowdown in net migration compared to five years ago. Home price growth in these four states was correspondingly sluggish.

- Single-family rent prices rose 2.3% year over year in July 2025, reflecting a deceleration from earlier months. Following a strong start to the year, annual rent growth weakened across metro areas and price tiers. The monthly growth rate registered at 0.2%, significantly below the historical July average of 0.7%. Markets such as Los Angeles, which were previously supported by post-wildfire demand, are now cooling off.

U.S. mortgage market trends

- The average monthly escrow payment increased by 45% from 2019 to 2025. Escrow payments have risen sharply in recent years. This jump has significantly increased the financial burden associated with homeownership for both prospective and current homeowners. States like Colorado, Florida, Wyoming, and South Dakota experienced the highest escrow cost hikes, driven by rising property taxes and insurance premiums linked to higher home values.

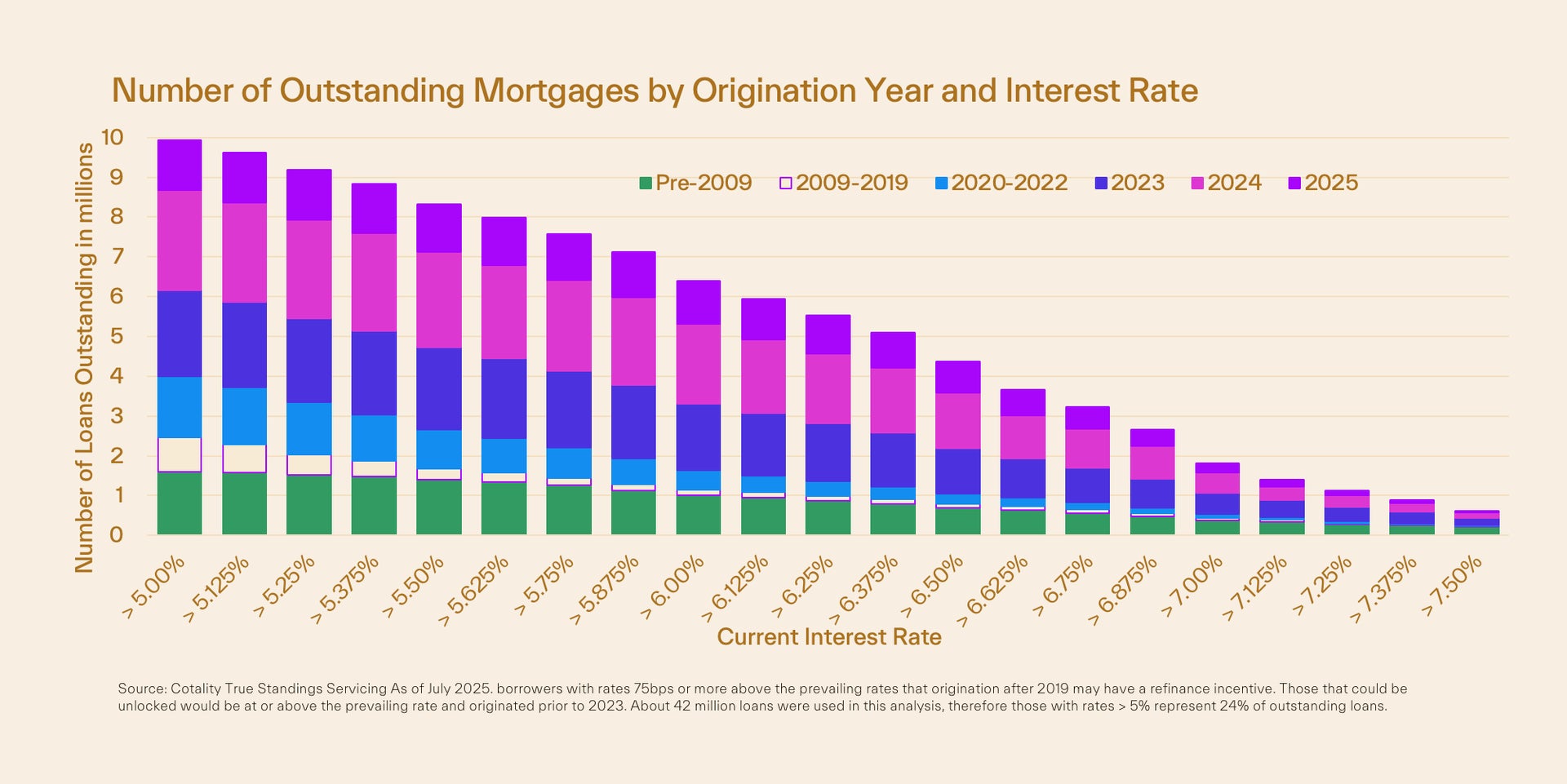

- Approximately 85% of outstanding mortgages carry interest rates below 6%, resulting in limited refinancing activity and a high degree of owner lock-in. If the 30-year mortgage rate falls to 6%, about 3 million borrowers would be primed for rate-and-term refinance, and nearly 2 million housing units currently held off the market could be unlocked.

- In the second quarter of 2025, the average borrower held $307,000 in home equity, but that figure declined by roughly $9,000 compared to the same time last year. Slower home equity gains reflect cooling home price trends and the 2025 trend of more people tapping into their home equity. However, homeowners in the Northeast continue to see their equity rise as home prices in the region remain on a steady incline.

- New construction sales hit their lowest level in 10 years, with just 500,000 new homes sold in the 12 months preceding August 31, 2025. This is more than 25% decline compared to the 12 months preceding August 31, 2022, during which more than 670,000 new homes were sold. Declines since 2022 were especially sharp in California and New York, where sales of new construction dropped 35% and 65% respectively. Florida recorded a 24% decline and Texas posted a 29% drop, which is more in line with the national average.

- The number of homes that are inherited has been increasing, and this summer that figure reached its highest point in the past decade. Over 300,000 homes were inherited during the 12 months prior to August 31, 2025. This figure is over 15% greater than the number recorded three years earlier. Inherited properties accounted for 7% of all property transfers. In California, where state law provides favorable tax treatment to inherited homes, inheritances represented more than 15% of transfers for the first time. In California, 57,000 homes were inherited compared to 25,000 new home purchases during the same period.

As mortgages rates fall, incentive to refinance and sell increases

Data source: Cotality, 2025

A view of property transfers (Aug. 2024 - Aug. 2025)

Data source: Cotality, 2025

About Cotality

Cotality accelerates data, insights, and workflows across the property ecosystem to enable industry professionals to surpass their ambitions and impact society. With billions of real-time data signals across the life cycle of a property, we unearth hidden risks and transformative opportunities for agents, lenders, carriers, and innovators. Get to know us at www.cotality.com.

Media Contact

Charity Head

Cotality