Press Release

Home price growth falls for sixth straight month in July

The S&P Cotality Case-Shiller Home Price Index, formerly known as the S&P CoreLogic Case-Shiller Home Price Index, is a leading measure of U.S. residential real estate prices.

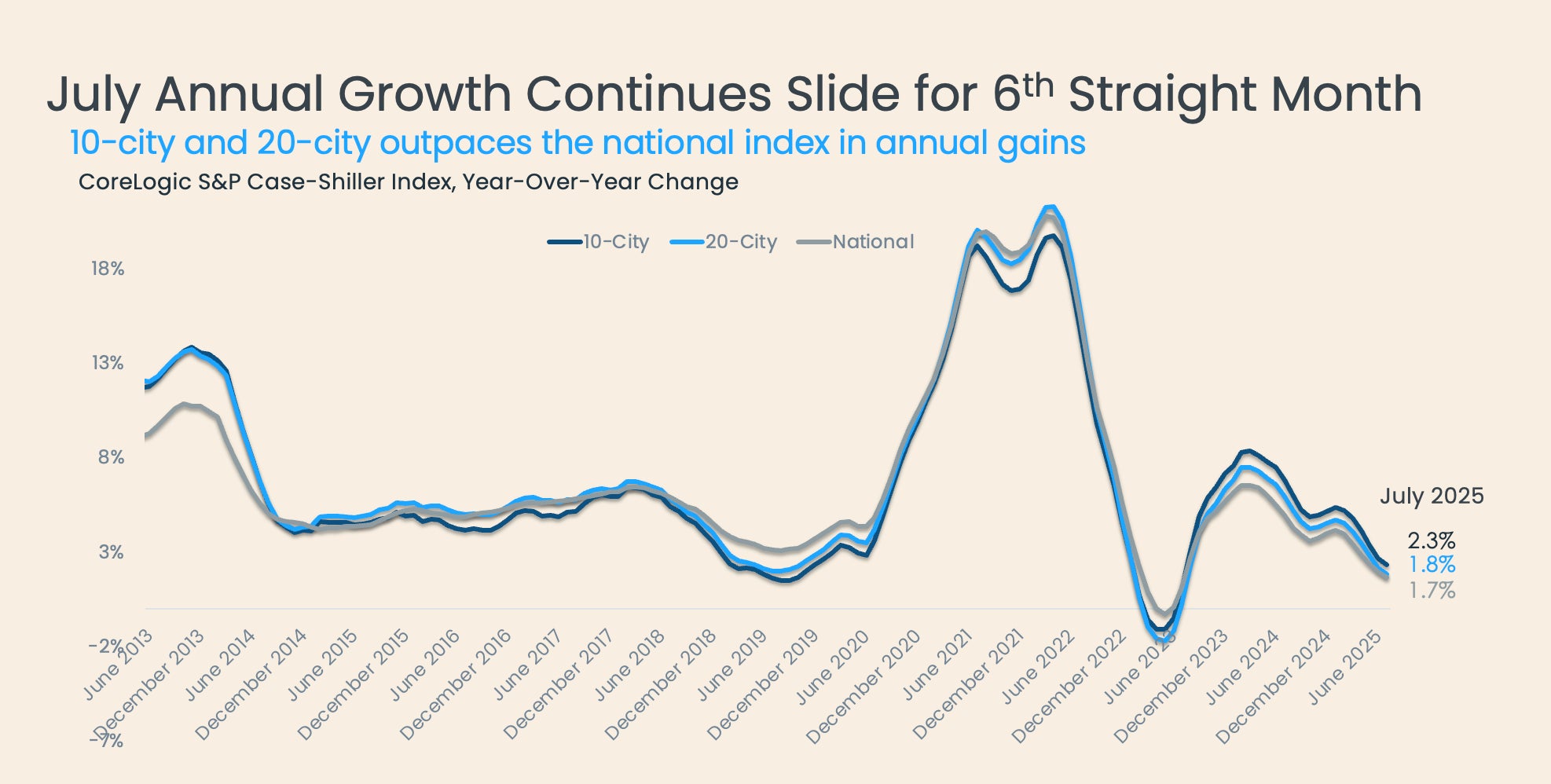

IRVINE, Calif., September 30, 2025 — It may feel hot in July, but the U.S. housing market exuded a considerable chill. The S&P Cotality Case-Shiller Index rose just 1.7% year over year in July, continuing a steady decline from the 4.1% growth recorded at the start of 2025 (Figure 1). Similarly, the 10-city and 20-city composite indexes posted monthly declines but remain positive on an annual basis, with growth rates of 2.3% and 1.8%, respectively.

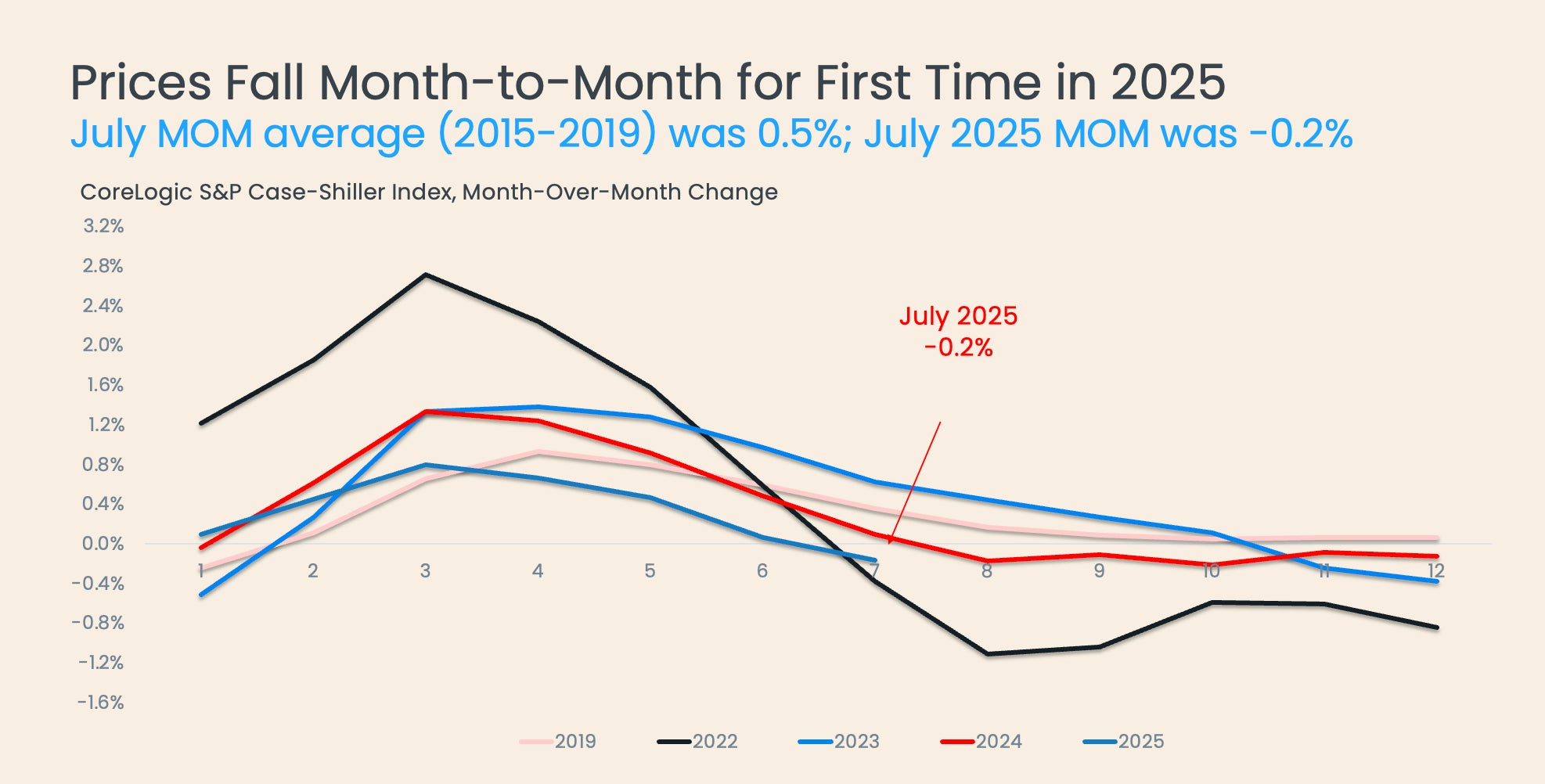

Month over month, the non-seasonally adjusted index fell by 0.2% (Figure 2). This is well below the pre-pandemic July average of 0.5% and marks the first monthly decline in 2025, further suggesting that softening may be ahead if historical patterns hold.

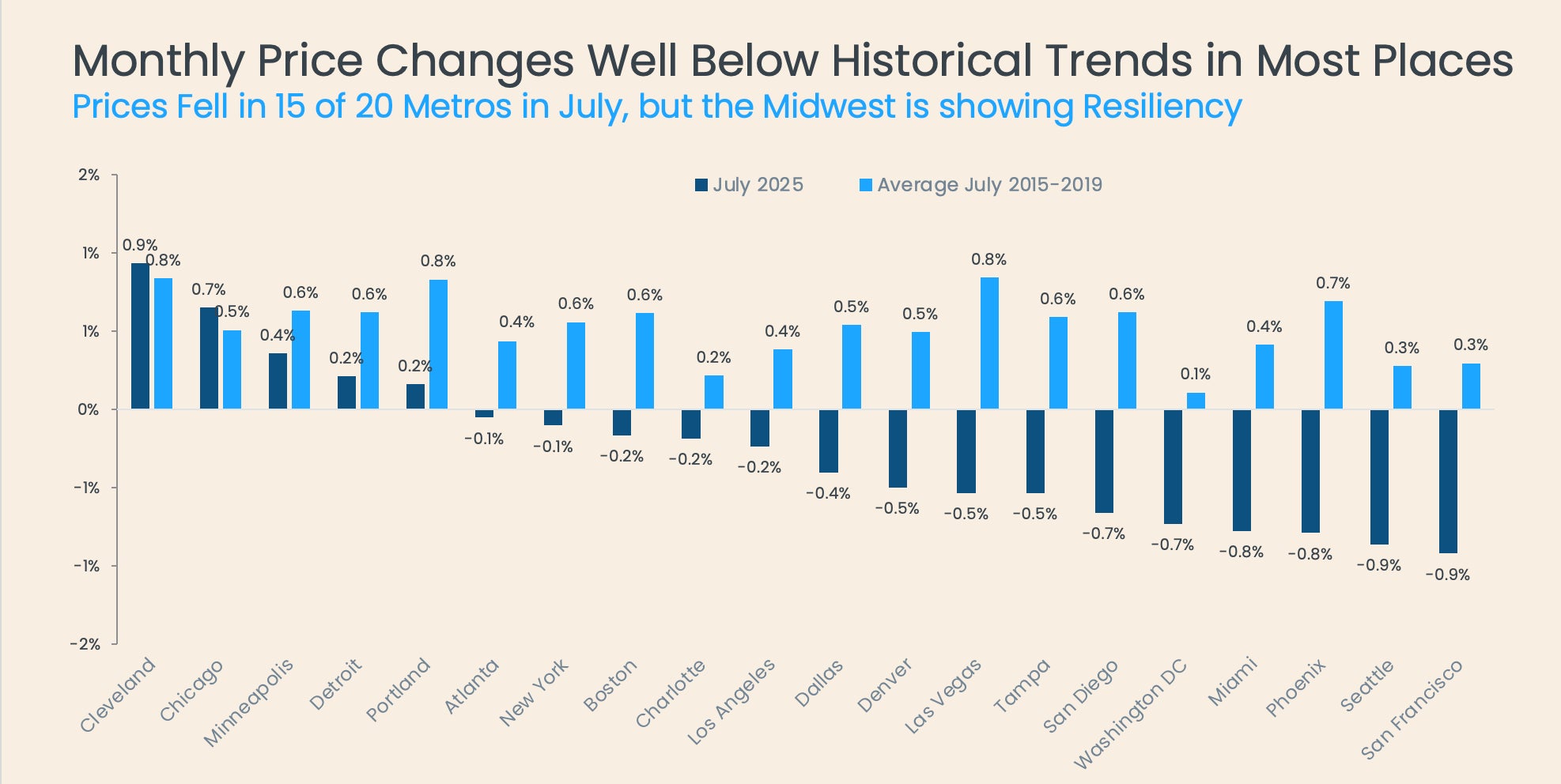

“July home price growth slowed to 1.7% annually and -0.2% monthly. The Midwest, however, is still showing resilience thanks to the region’s affordability. Cleveland and Chicago posted monthly gains above their pre-pandemic averages, but that trend may not hold,” said Cotality Principal Economist Thom Malone. “Elsewhere, gains were scarce. Metros in the West and the South bore the brunt of the slowdown, with Tampa, Miami, San Francisco, and Dallas all experiencing annual declines of more than one percentage point. The weakness in these areas stems from a combination of rising insurance premiums due to hazard risks and lingering affordability issues following strong pandemic-era appreciation.”

Data source: S&P Cotality Case-Shiller Indices, not seasonally adjusted (September30, 2025)

Data source: S&P Cotality Case-Shiller Indices, not seasonally adjusted (September30,2025)

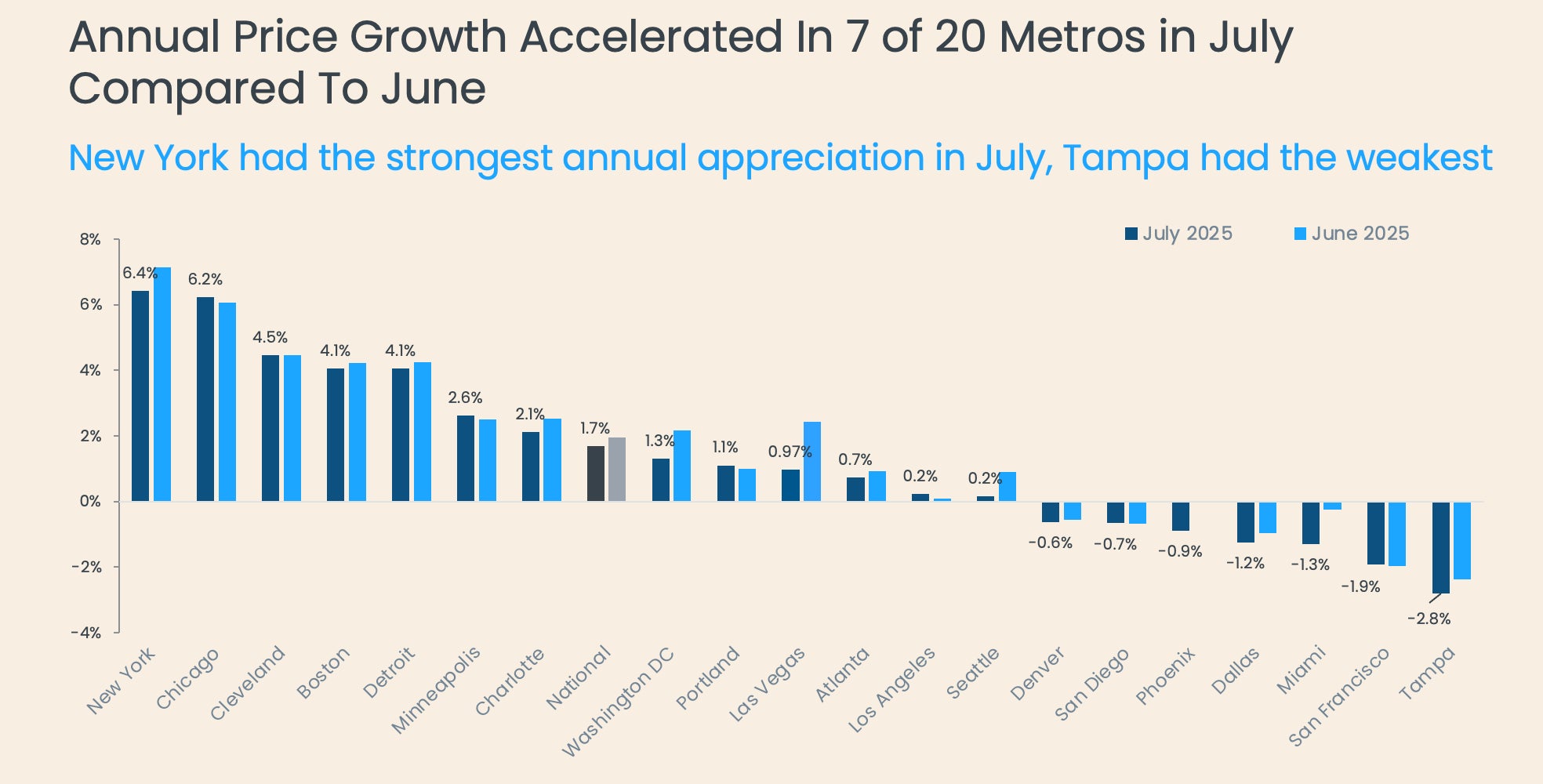

In July, seven of the 20 metros in the 20-City Index saw year-over-year price growth compared to June (Figure 3). New York, Chicago, and Cleveland led the pack with annual increases of 6.4%, 6.2%, and 4.5%, respectively. Cleveland and Chicago were also the only cities to post monthly price gains above typical July levels, underscoring their relative strength in an otherwise weak national market.

Meanwhile, seven metros posted annual declines, with Tampa showing the steepest drop at -2.8%. Northeastern metros like New York and Boston may soon fall behind Midwestern cities in terms of price growth. The widespread slowdown suggests that market weakness will continue for the rest of 2025.

Data source: S&P Cotality Case-Shiller Indices, not seasonally adjusted (September30, 2025)

On a monthly basis, San Francisco saw the sharpest declines, with prices falling -0.9% in July (Figure 4). Seattle, Phoenix, Miami, and Washington, D.C. also posted notable monthly price declines of -0.9%, -0.8%, -0.8%, and -0.7%, respectively. Only five metros recorded monthly price increases, four of which were in the Midwest: Cleveland, Chicago, Minneapolis, and Detroit (Figure 4).

Data source: S&P Cotality Case-Shiller Indices, not seasonally adjusted (September30, 2025)

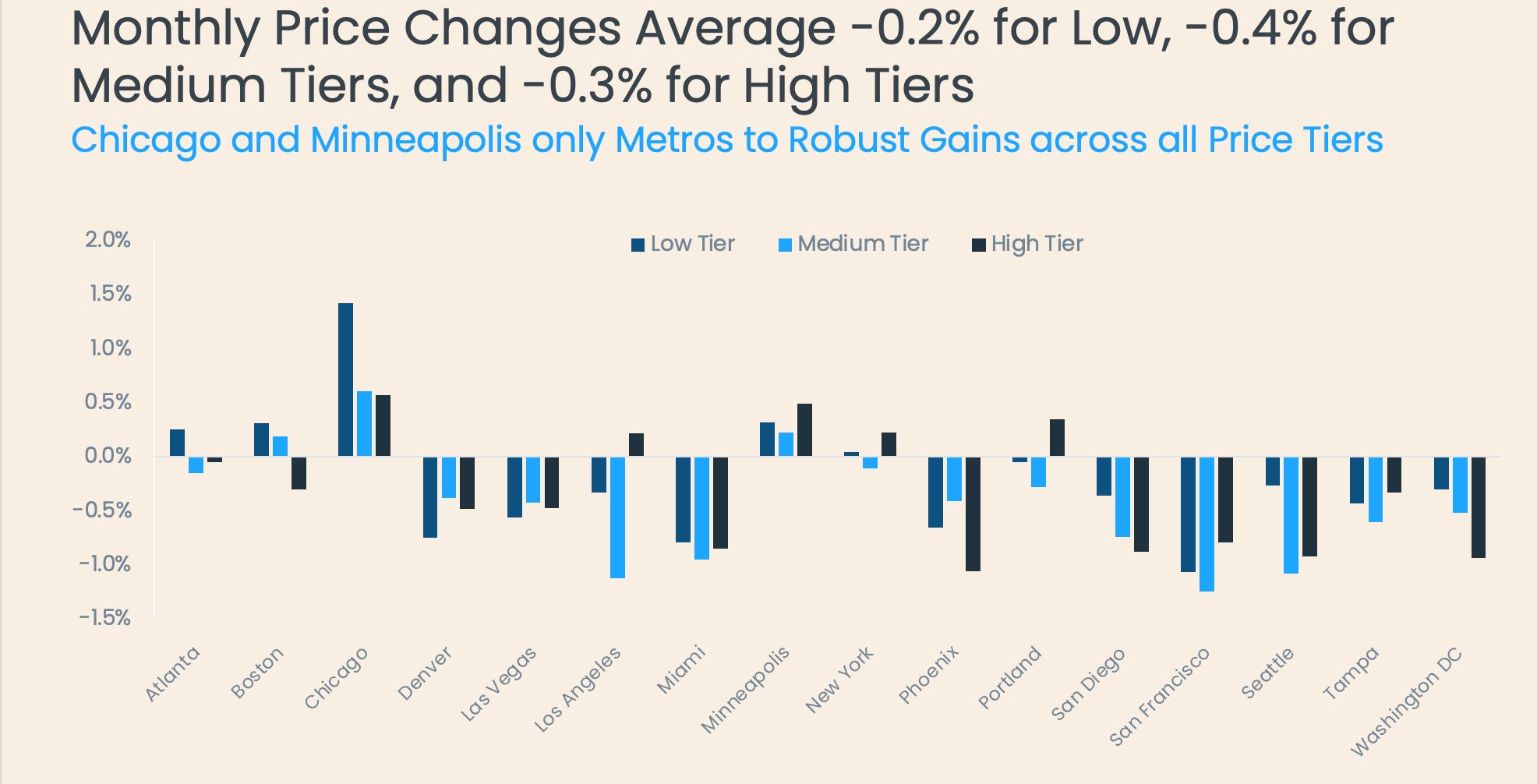

Prices declined across all market segments, with average monthly drops of -0.2% for low-priced homes, -0.4% for mid-priced homes, and -0.3% for high-priced homes (Figure 5). These declines were consistent across all tiers and metros. Chicago and Minneapolis were the only cities to post gains in every segment.

Data source: S&P Cotality Case-Shiller Indices, not seasonally adjusted (September30, 2025)

July’s monthly decline is the first indication that the market is shifting. Inventory levels are beginning to rise in many areas, signaling that sellers may be starting to concede ground through price reductions. However, without a strong external shock, buyers are likely to remain cautious, so any price declines through the end of 2025 will be modest. Eventually, falling interest rates, longer periods spent listed on the market, and rising inventory could reach a tipping point that will set the stage for price growth to resume — but that moment may still be some time away.