Press Release

10 Things to Know About the Property Market: July 2025

IRVINE, Calif., July 31, 2025 — The U.S. condo market in 2025 is under pressure, shaped by shifting demographics, regional concentration, and slowing sales. Millennials lead in mortgage applications, but older generations show stronger preferences for condos. Investor activity remains significant in this sector, though often undercounted in mortgage data due to cash purchases. Inventory has also grown, and condos are taking longer to sell compared to single-family homes. Despite declining sales, condos maintain a steady share of overall transactions, with notable concentration in states like Florida, Hawaii, and Washington D.C.

On the financing side, condos rely more heavily on conventional loans and have seen a drop in purchase originations. Price growth has softened, and some metros are even showing declines. Despite headwinds, mortgage performance is strong, outperforming mortgages on detached properties. .

Buyer demographics and behavior

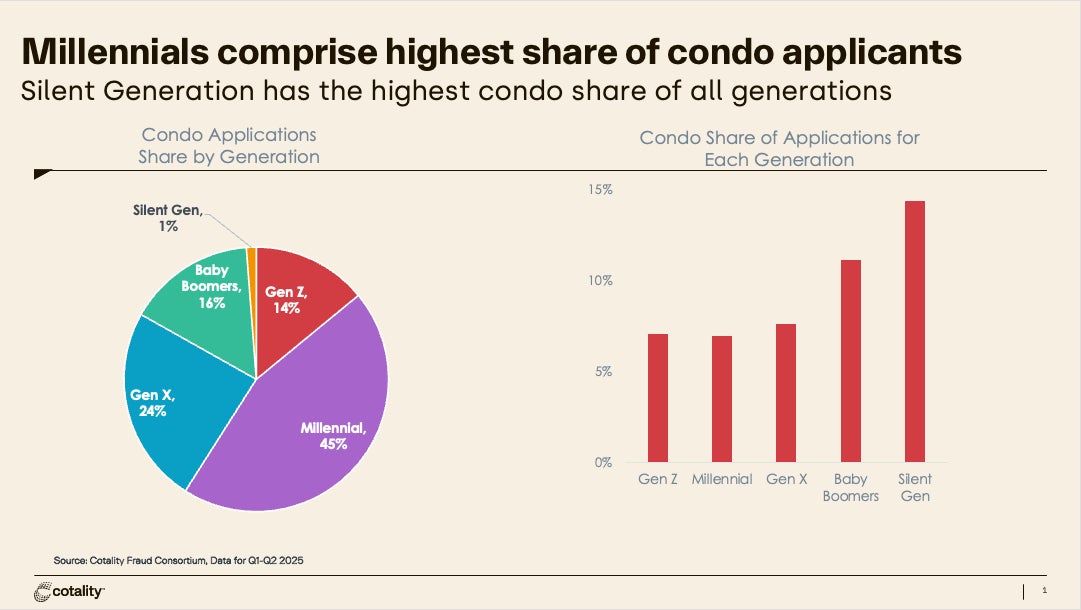

1. In the first half of 2025, Millennials made up 45% of all condo mortgage applications, largely due to their population size. However, there is a generational divide in housing choice. When looking at property type preferences by generation, older buyers show a stronger inclination toward condos: 14% of Silent Generation and 11% of Baby Boomer applications were for condos, compared to less than 10% among Gen X, Millennials, and Gen Z.

2. Repeat buyers — likely driven by older generations — make up roughly half of condo mortgage applicants. Investors account for 19%. Since many investors purchase without financing, the true share of investor activity in the condo market is likely even higher than the mortgage application data suggests. This trend is reflected in homeownership rates by property type: while single-unit detached homes are 85% owner-occupied, that figure drops to 60% for condos and highlights the stronger presence of single-family investors in the condo segment.

Sales activity and inventory trends

3. Listings data shows that nationwide condo inventory has been building steadily over the past year. Condo inventory declined through mid-2022 before surging nearly 80% by mid-2024 and continuing to build at a slower pace into mid-2025. At the same time, the average time from listing to contract signing has lengthened significantly. Since 2022, time to close rose from under 30 days to roughly 90 days in mid-2025. By comparison, non-condo inventory is slightly down, and those properties are selling about 30 days faster than condos, highlighting a growing gap in market momentum.

4. While overall condo sales have declined along with the broader housing market, their share has held steady at around 10% over the past decade — down slightly from a peak of 12% in 2005. This steady share masks dramatic regional differences: condos account for 55% of sales in Hawaii and represent a similarly high proportion of sales in Washington, D.C.. In Florida, where condos make up just 16% of the state’s sales, the condo market represents a striking 18% of all condo sales nationwide.

5. Some Florida metros have historically high condo shares — 41% in Greater Miami and 40% in Naples in 2024 — with consistent levels between 40% and 50% since 2000. However, condo share declined notably across the state after the Great Financial Crisis before declining further after the Surfside collapse in 2021. Nearly every Florida metro saw a drop from 2021 to 2024. The market now faces headwinds from rising insurance premiums, stricter safety regulations on older buildings, and reduced domestic and international migration. This has dampened demand, especially among retirees and fixed-income buyers.

6. Sales of newly constructed condos dropped 8% year over year, totaling 42,000 units from June 2024 to May 2025. New York led the pack with over 7,400 sales, which is more than triple Detroit’s 2,300 sales. Only six other metros — Austin, Los Angeles, Riverside, San Diego, Washington, D.C. — surpassed 1,000 sales, underscoring how condo activity remains concentrated in major urban markets, unlike single-family homes, which are more widely spread across the South and the Sun Belt.

Mortgage market trends

7. According to Cotality data, condo prices in large U.S. metros, prices are weakening for 2025. This is a shift from last year’s trend of broad price growth. Only Boston and Chicago are seeing strong price increases, while Miami, Washington, D.C., and Los Angeles are experiencing declines. In April 2025, condo prices were down 1.9% in Miami, 1.2% in Los Angeles, and 0.6% in Washington, D.C. compared to a year earlier.

8. According to Cotality data, overall sales weakness has led to a 2% year-over-year drop in condo purchase originations, slipping from a peak of $148 billion in 2021 to $83 billion in 2024. In contrast, single-family detached purchase originations, which had mirrored condo trends until recently, rose by approximately 6% in 2024.

9. Condo mortgages skew more conventional. In the first half of 2025, 86% of condo purchase mortgages were conventional, compared to 70% for single-family detached homes, according to Cotality data. This reflects a lower reliance on FHA and VA loans in the condo market.

10. Condo mortgages outperform detached mortgages. As of May 2025, condo mortgages have lower delinquency and foreclosure rates compared to detached homes. Delinquency rates (30+ days past due, excluding foreclosure) were 1.5% for condos versus 2.8% for detached properties. Foreclosure rates were also lower for condos at 0.2%, compared to 0.3% for detached. While condo foreclosure rates were 1.5 times higher during the financial crisis (2008–2014), they have remained lower both before and after that period.