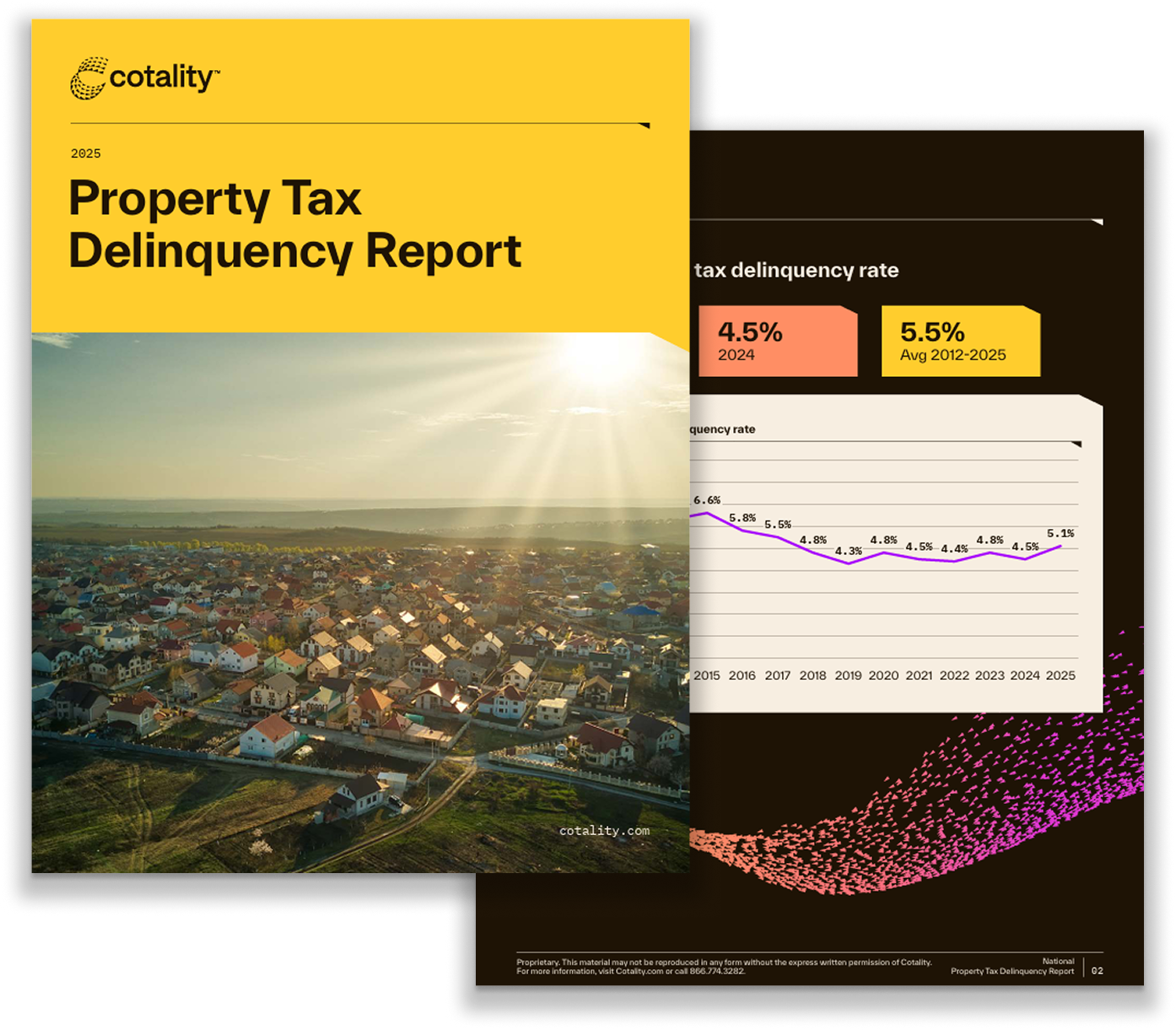

Tax delinquency rates are rising again in 2025, hitting 5.1% YTD nationally. This report analyzes over 15M tax events from 8M non-escrowed loans to uncover where risk is growing and why. Includes state-by-state rankings, historical trends, and correlations between unemployment, affordability, and delinquency.

- Leading risk indicator

Tax delinquency on non-escrow loans is often the first sign of financial distress—offering servicers an early warning system before mortgage defaults occur. - Geographic risk insight

The report helps identify which states are most vulnerable based on tax policy, unemployment, and income levels—informing smarter servicing strategies. - Affordability pressure

Property taxes rose over 27% nationally since 2019, with some states seeing annual increases of 10% or more. That strain is now showing up in payment behavior.