Servicers: From stress to success during property tax cycles

High-volume tax cycles don't have to be a stressful exercises in error-prone manual data handling.

The annual property tax cycle is a critical wave of volume for servicing teams, with approximately 50% of all payments due in a short, high-pressure window. Because states vary in payment dates, your busy season may be concentrated or spread throughout the year.

Navigating your payment seasons while maintaining compliance can be intense. Luckily, technology can help across the board.

Here are three strategies to help your team maximize accuracy, increase operational efficiency, and turn homeowner confusion into clarity.

Strategy 1: Get a jumpstart with a pre-cycle cleanup

Your best defense against a chaotic tax cycle is rigorous, pre-cycle data cleanup. This preventive work prevents issues that could slow down payments and increase your staff workload later.

A little prep work goes a long way

Performing an audit before the large cycles begin helps reduce issues when volume is highest. You can conduct the portfolio audit to identify loans with exceptions.

- Validate legal descriptions on new loans: Ensuring accurate legal descriptions is crucial for correct loan onboarding and tax payments.

- Cleanup duplicate tax IDs and parcel mismatches: For instance, our Tax Amount Reporting (TAR) shows tax IDs that are duplicated inside your portfolio or others. Clear these to reduce refunds and manual TARs.

- Master key agency due dates and ELDs: Understand the difference between the due date, discount date, and the Economic Loss Date (ELD).

- Manage to reporting cutoff dates: Ensure loans are fully boarded before the reporting cutoff date, so taxes will be reported for upcoming cycles. Keep in mind that escrow and non-escrow loans have different cutoff dates, depending on the state and/or agency.

- Resolve all suspended loan items: Consistently review and resolve any contracted suspended items to ensure the loan is included in the cycle reporting.

- Understand manual reporting requirements: Review and follow manual agency requirements closely to ensure payments sent directly to taxing authorities aren't returned.

Strategy 2: Arm yourself with real-time portfolio and agency visibility

Relying solely on spreadsheets or waiting for emailed reports can slow you down and become quickly outdated.

Real-time visibility into your portfolio allows your team to move quickly from data searching to decision-making, ensuring accuracy at every turn. It can even help you plan for payment spikes and minimize late payment risk.

Here are some DigitalTax Portal tools and reports that will help minimize your risks:

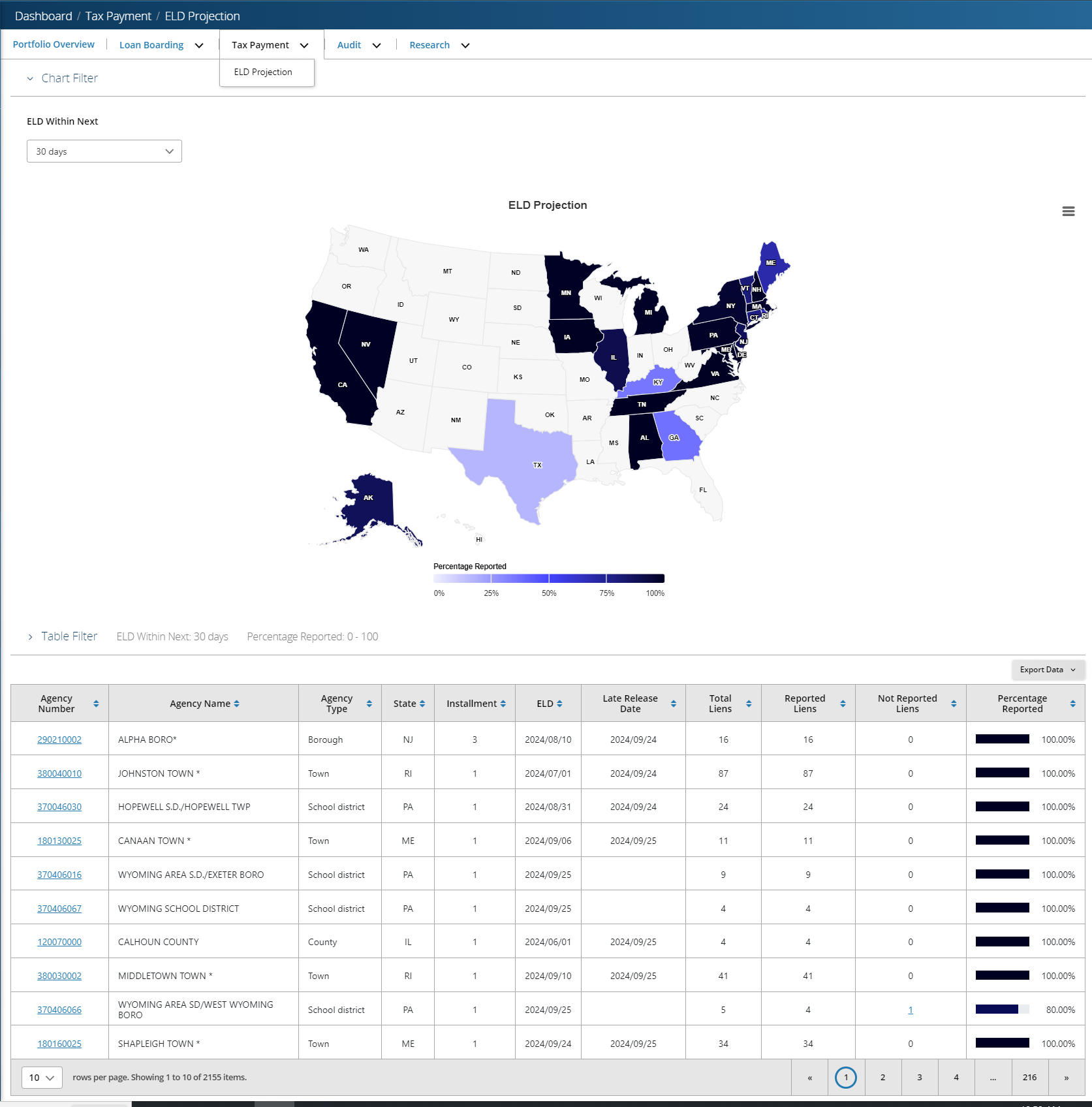

- ELD projection dashboard: Cotality users rely on this dashboard for agency details, ELDs, and loan reporting status — including completion percentages, pending loans, and tax types.

- Tax Amount Reporting (TAR) calendar: Reflects estimated dates that clients can expect tax amounts to be reported

- National Due Date Change Listing (NDDCL): Tracks changes to taxing authorities’ ELDs.

- Pending apportionment dashboard: Highlights potential issues with loans coded as 'To Be Apportioned' parcels.

- Legal/Situs discrepancy dashboard: Loans are flagged for legal or situs discrepancies, helping you spot and resolve issues across all service types — reducing reporting errors, payment issues and refunds.

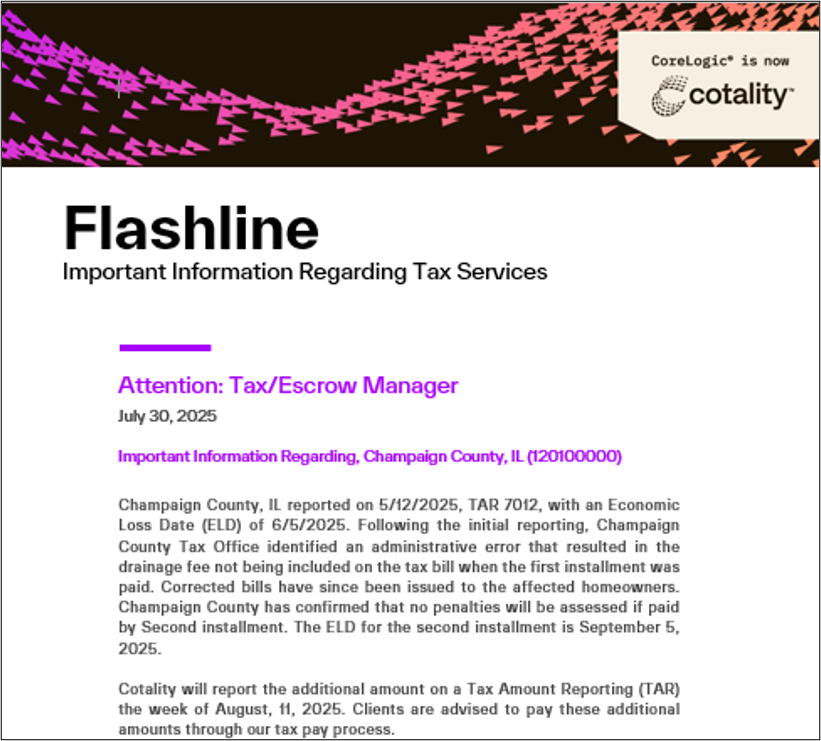

Since taxing authority information and due dates often change at the last minute, you’ll need to stay up to date in real time using resources like our Knowledge Center or keep up with agency websites. Watch for official notifications (aka, “Flashlines” for Cotality users) and bookmark reports to track due date and address updates.

Explore dashboards and workflow tools in DigitalTax Portal.

Strategy 3: Stay ahead of call spikes with modern communication tactics

Tax issues can be stressful and confusing for homeowners. A proactive communication strategy is your best tool for managing call volume and building trust with your borrowers.

For instance, Cotality operates the nation’s largest tax call center, and the most common question we hear is simple: “Were my taxes paid?” It’s ideal to answer that without human interaction. So, when our phone system recognizes the caller’s loan, they hear: “It looks like you’re calling about your current bill. Your payment is scheduled for [Date] in the amount of [Amount].”

We also recommend:

- Educating clients about regional tax options proactively: Use your communication channels to tell borrowers about specific state options, like the five different payment options offered in Wisconsin.

- Making 1098 forms easy for borrowers to find and access through your web portals: This will keep them from picking up the phone.

- Leveraging automated updates (SMS, Email): Automated communication gives homeowners peace of mind. Servicers who enable automated text updates see a material reduction in duplicate calls each month.

- Using tax-data enriched Interactive Voice Response (IVR) systems to handle other routine questions: Like the example above, automated systems can answer routine questions, freeing up agents to handle complex issues. In fact, 52% of our tax calls are resolved through self-service.

Get more homeowner communication tips.

-

Tax payments must be on time and accurate. We can help.

By adopting new strategies — from cleaning up data mismatches and using real-time dashboards to proactively communicating with borrowers — you can reduce risk, increase your operational efficiency, and create customer loyalty.

As the market leader with 80+ years in the tax industry, our expert teams can help transform your processes. See why over 80% of all U.S. mortgages are under our tax care.