Press Release

Single-family rent growth hits lowest level in over 15 years

U.S. single-family rent prices increased 1.4% year over year in August 2025

- Annual rent growth weakened at all price levels in August, continuing the slowing trend seen in the second half of 2025.

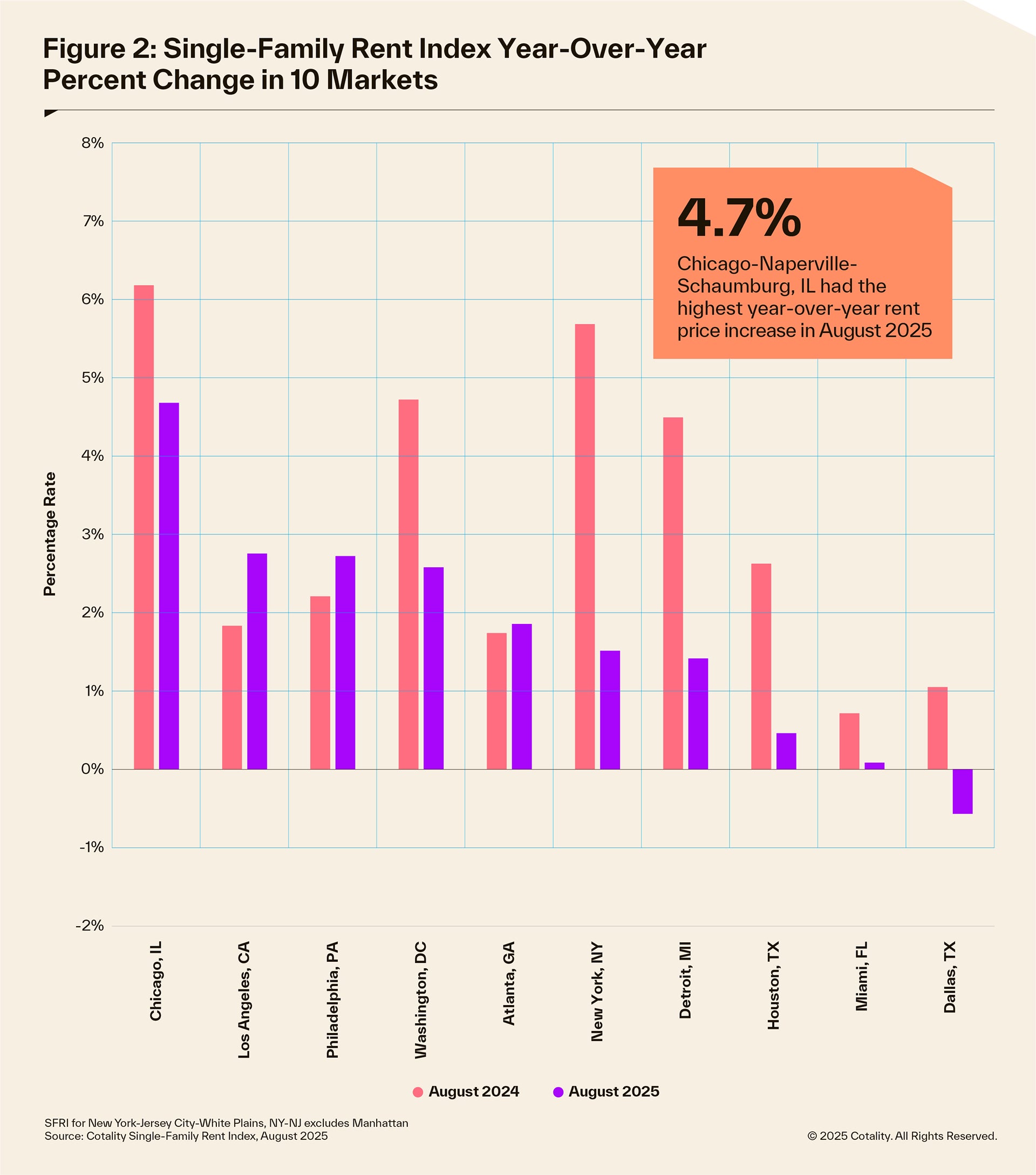

- Chicago saw the highest year-over-year rent price increases in the U.S. at 4.7%.

- Rent growth weakened in most other large metros in August compared with prior-year growth. Exceptions to this trend were Atlanta, Philadelphia, and Los Angeles. All three of these metros have been bucking the slowdown trend.

IRVINE, Calif., October 23, 2025 – Cotality, a leading global property information, analytics, and data-enabled solutions provider, released its latest Single-Family Rent Index (SFRI) for August 2025, which analyzes single-family rent price changes nationally and across major metropolitan areas. Single-family rent prices in August 2025 increased 1.4% from August 2024, which is significantly less than the 3% average increase a year ago.

“Annual single-family rent growth fell to its lowest level in more than 15 years this August, highlighting a notable shift in the rental market,” said Molly Boesel, Senior Principal Economist at Cotality. “We’re seeing slower growth across price tiers and in many major metros. That said, not all areas are following the same pattern. Atlanta, Philadelphia, and Los Angeles continue to show stronger rent growth, with Los Angeles now only slightly above its pre-wildfire level from January. Los Angeles ranks second among the top 10 metros for rent growth, suggesting that local conditions such as recovery efforts, limited housing supply, and regional economic factors can still influence rental trends even as national price growth moderates.”

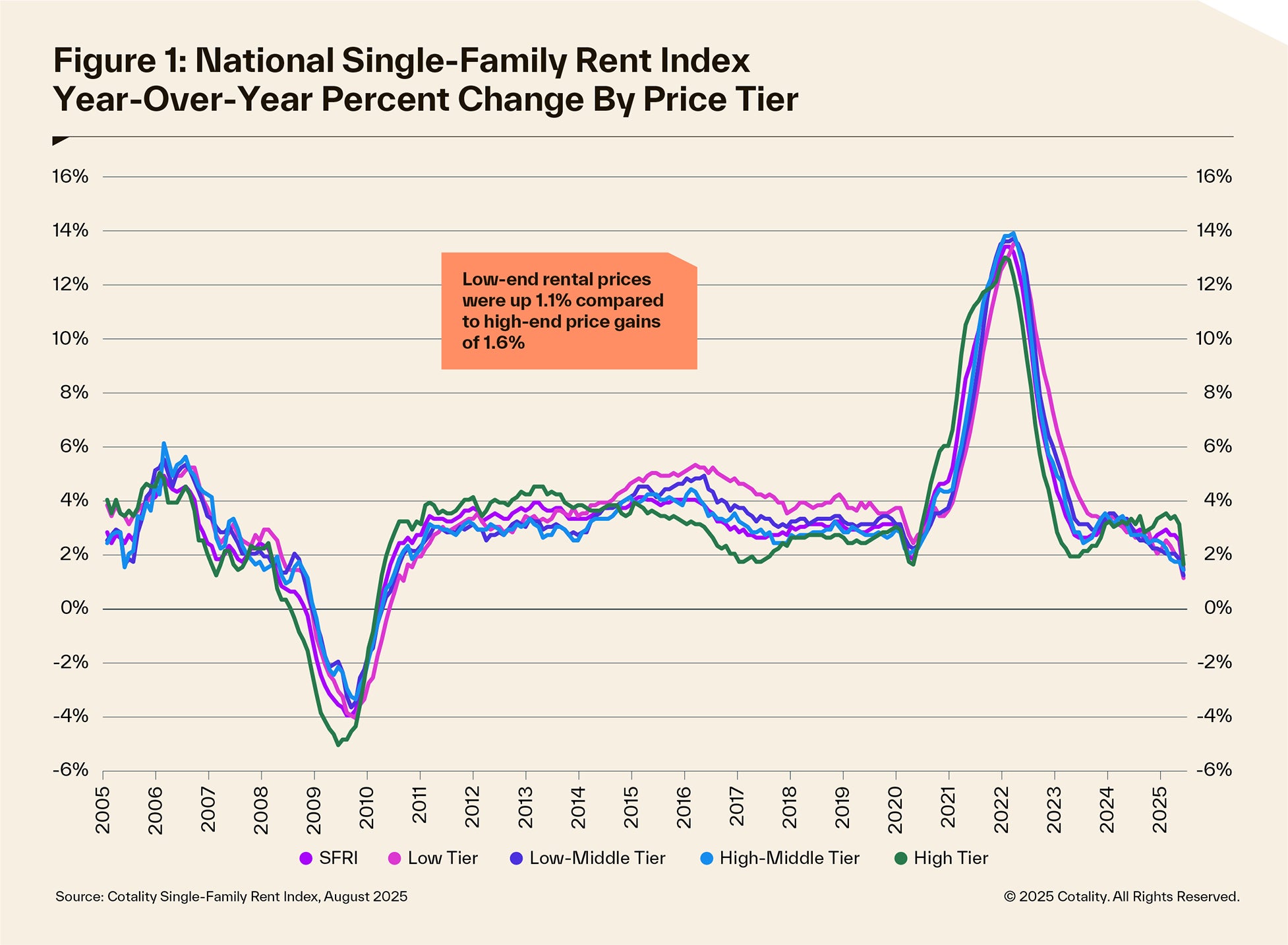

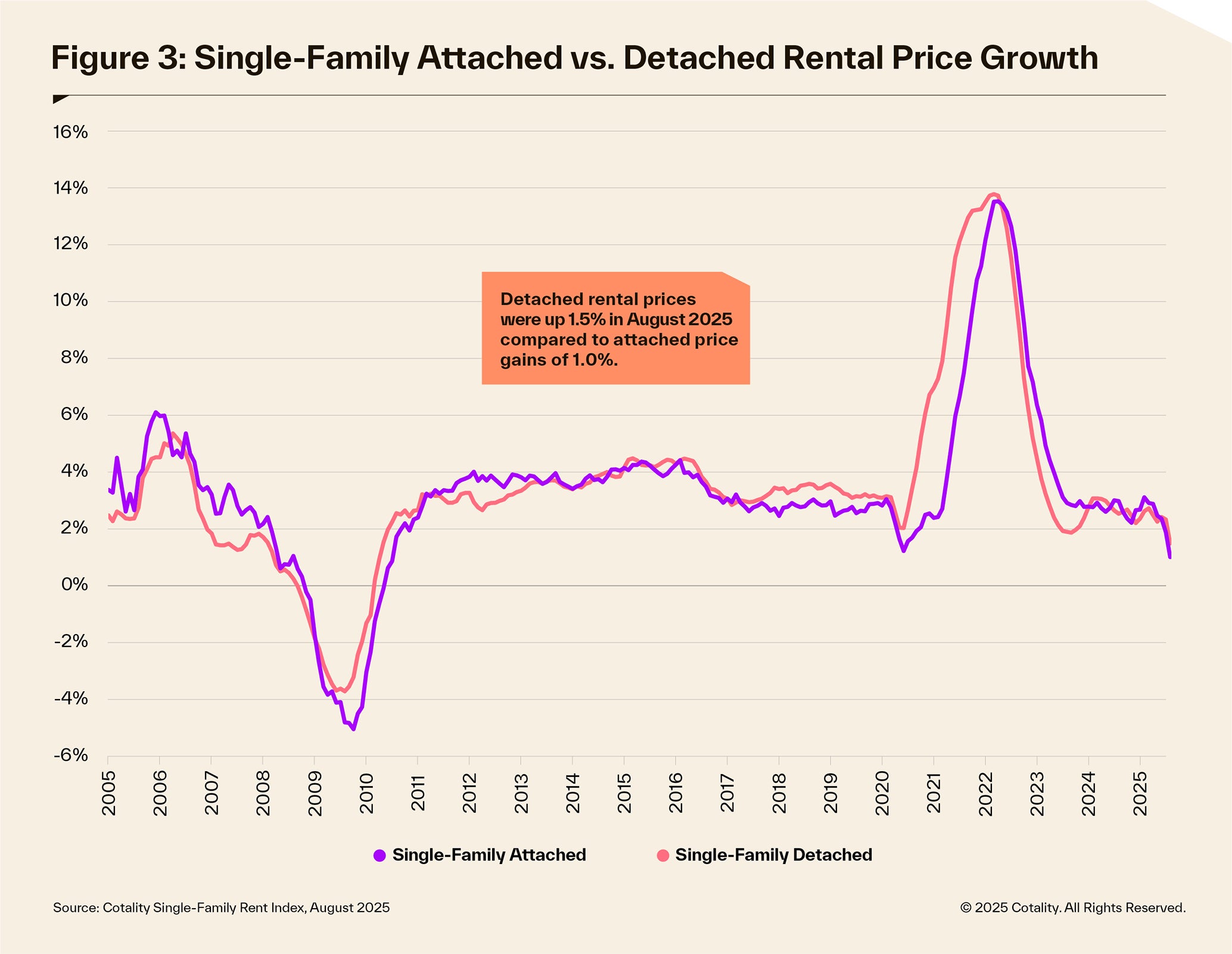

Rent in both high-end and low-end price tiers climbed just slightly year over year. High-end properties saw strong growth for the last several months. Rent prices for high-end properties increased 1.6% year over year in August 2025, a drop from the year-over-year gain of 3.3% in August 2024. Low-end rent prices increased 1.1% year over year in August 2025, down from a 2.8% gain in August 2024. Rent for detached rentals grew by 1.5%, and attached rental rates rose by 1% in August 2025.

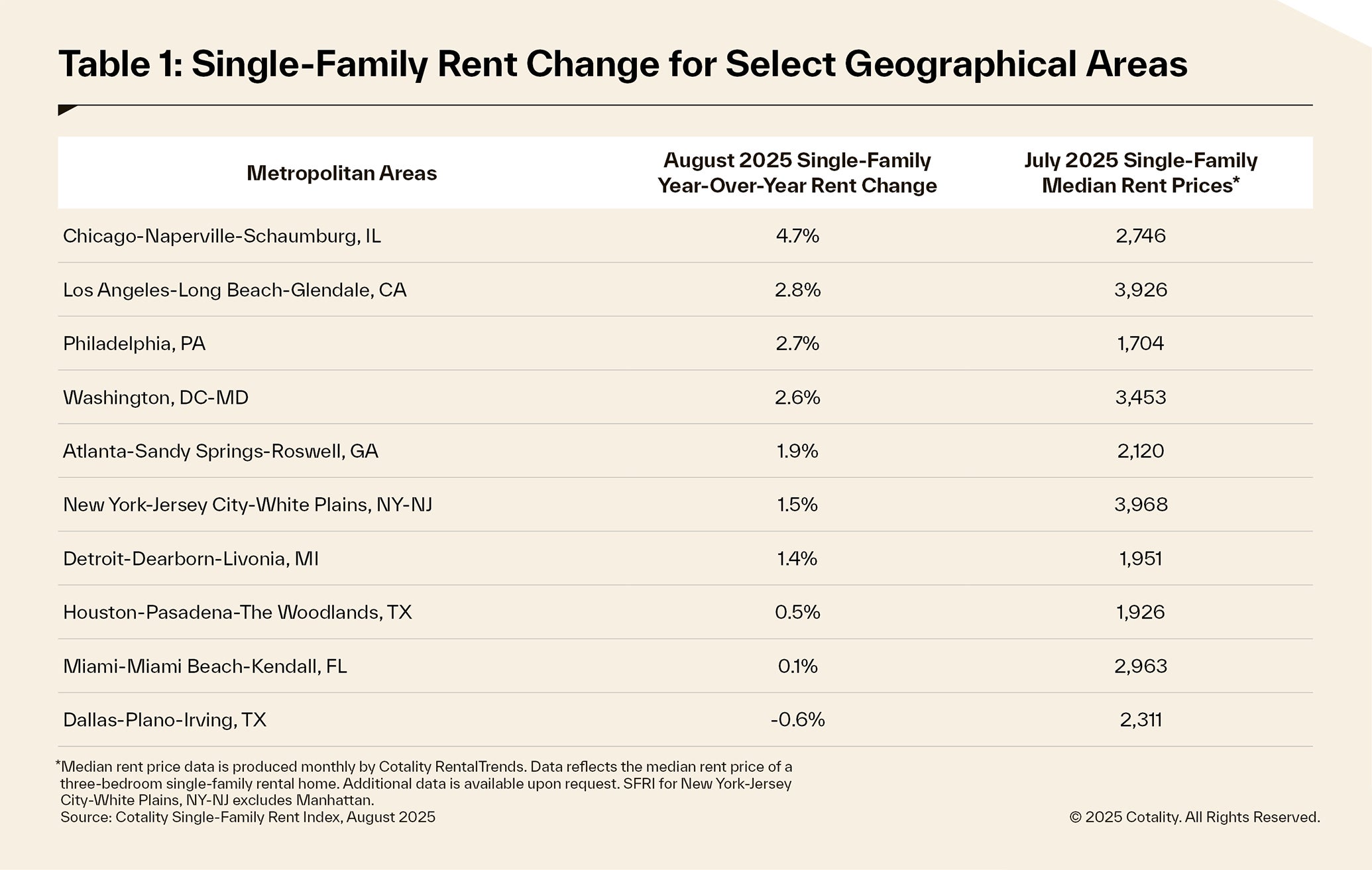

Among the largest 10 metro areas, Chicago remained at the top of the list for the highest rent growth at 4.7% in August 2025. Los Angeles followed at 2.8%, Philadelphia rose 2.7%, Washington, D.C. was up 2.6%, and Atlanta rents climbed 1.9%. Dallas recorded a 0.6% decline in rent growth in August 2025, making it the lowest in the nation. Single-family rent growth in the Dallas metro area has been mostly hovering around 0% for the past year thanks to a large number of multifamily rental units coming online and giving renters some bargaining power.

The next Cotality Single-Family Rent Index will be released on November 20, featuring data for September 2025. For ongoing housing trends and data, visit the Cotality Insights blog: www.cotality.com/insights.

Methodology

The Cotality Single-Family Rent Index (SFRI) applies a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. The rental listings used to calculate the index include both attached and detached single-family homes, as well as condominiums. This report shows trends for the U.S. and the largest 10 U.S. metropolitan areas. In addition to these 10 metros, the Cotality SFRI is available for close to 100 metropolitan areas — including approximately 50 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The Cotality Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by Cotality Rental Trends. Rental Trends is built on a database of more than 11 million rental properties (over 75% of all U.S. individually owned rental properties) and covers all 50 states and 17,500 ZIP codes.

About Cotality

Cotality accelerates data, insights, and workflows across the property ecosystem to enable industry professionals to surpass their ambitions and impact society. With billions of real-time data signals across the life cycle of a property, we unearth hidden risks and transformative opportunities for agents, lenders, carriers, and innovators. Get to know us at www.cotality.com.

Media Contact

Charity Head

Cotality