Press Release

Late-stage missed payments raise delinquency rates

The national mortgage delinquency rate held steady at 3% in September 2025.

- While the delinquency rate was unchanged year over year, it was slightly up from 2.9% in Q2, signaling stability amid subtle signs of borrower stress.

- Serious delinquencies inch upward, rising to 1% in September 2025 from 0.9% a year earlier, with the rate hovering in a narrow range since mid-2024.

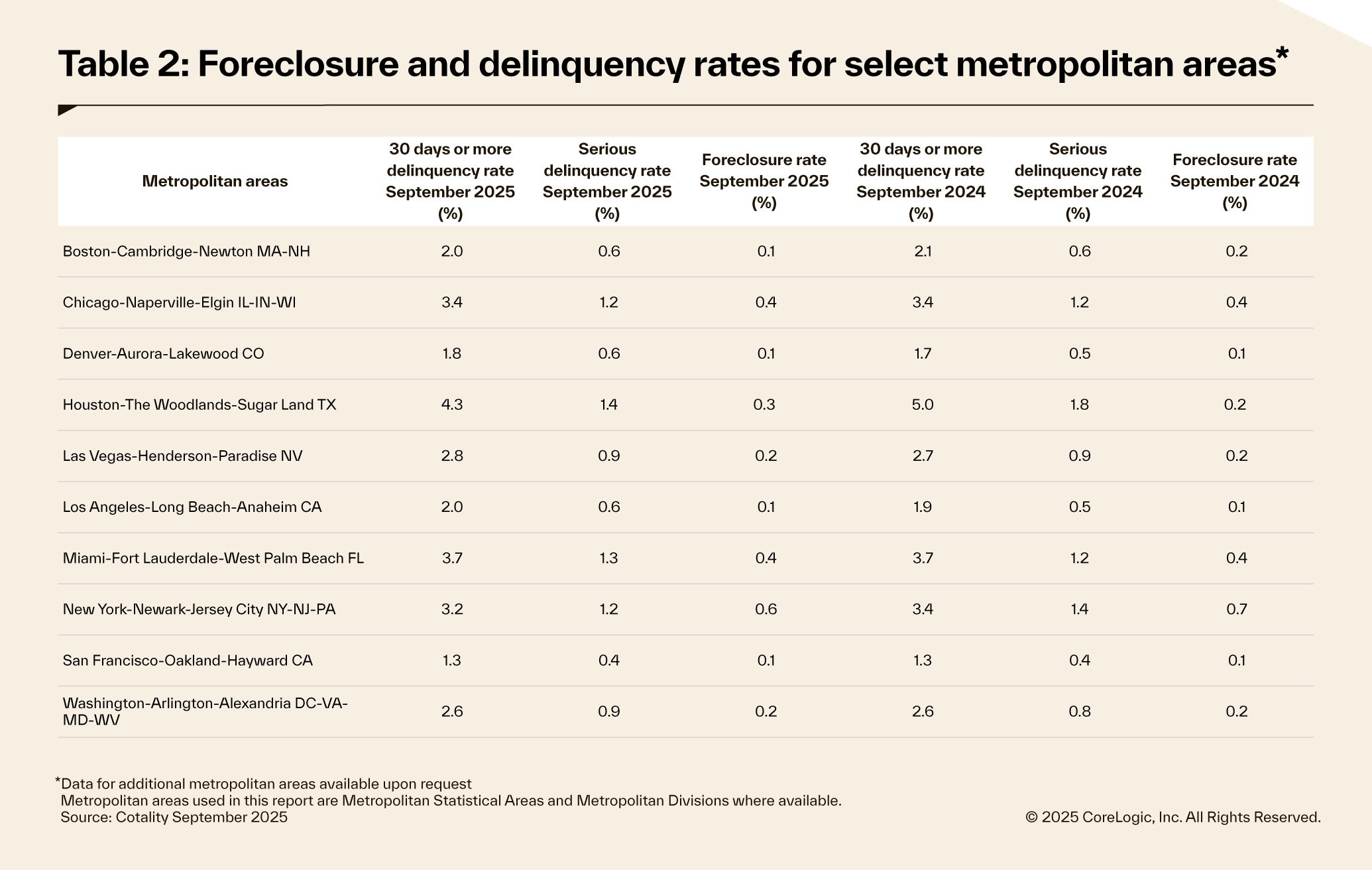

- Metro-level trends reveal growing challenges for delinquent borrowers, with the share of areas experiencing rising foreclosure rates jumping from 8% to 39% year over year, despite a stable national foreclosure inventory rate of 0.3%.

IRVINE, Calif., December 9, 2025 – Cotality, a leading global property information, analytics, and data-enabled solutions provider, today released its latest Loan Performance Indicators, which analyzes mortgage delinquencies nationally and across major metropolitan areas. In September 2025, the share of mortgages in some stage of delinquency (30 or more days past due, including foreclosures) was 3%, which was unchanged from 2024. However, delinquencies increased slightly from 2.9% in the second quarter of 2025.

“The national delinquency rate has remained relatively stable over the past year and quarter. It is still up from the record lows seen in mid-2024. Even so, delinquencies remain low by historical standards, at just a quarter of the peak levels experienced during the Great Financial Crisis,” said Molly Boesel, Senior Principal Economist at Cotality. “However, we’re seeing signs of stress beneath the surface and some indication that borrowers who fall behind are struggling to catch up, progressing into later stages of delinquency. This is particularly evident at the metro level, where the share of areas with rising overall delinquencies declined from 70 percent in September 2024 to 48 percent in September 2025. Yet, the share with increasing foreclosure rates jumped from 8 percent to 39 percent over the same period. These trends suggest growing challenges for borrowers once they become delinquent.”

Despite concerns that borrowers may struggle to become current after falling into delinquency, the U.S. foreclosure inventory rate remained unchanged year over year at 0.3% in September 2025 and near the historical low of 0.2%.

Cotality examines all delinquency stages to gain a complete view of the mortgage market and loan performance health. In September 2025, the U.S. delinquency and transition rates and their year-over-year changes were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.6%, unchanged from 1.6% in September 2024.

- Adverse Delinquency (60 to 89 days past due): 0.5%, unchanged from September 2024.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1%, an increase from 0.9% in September 2024. The serious delinquency rate has been moving in a narrow range of 0.9% to 1.0% since June 2024.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, down from 0.8% in September 2024.

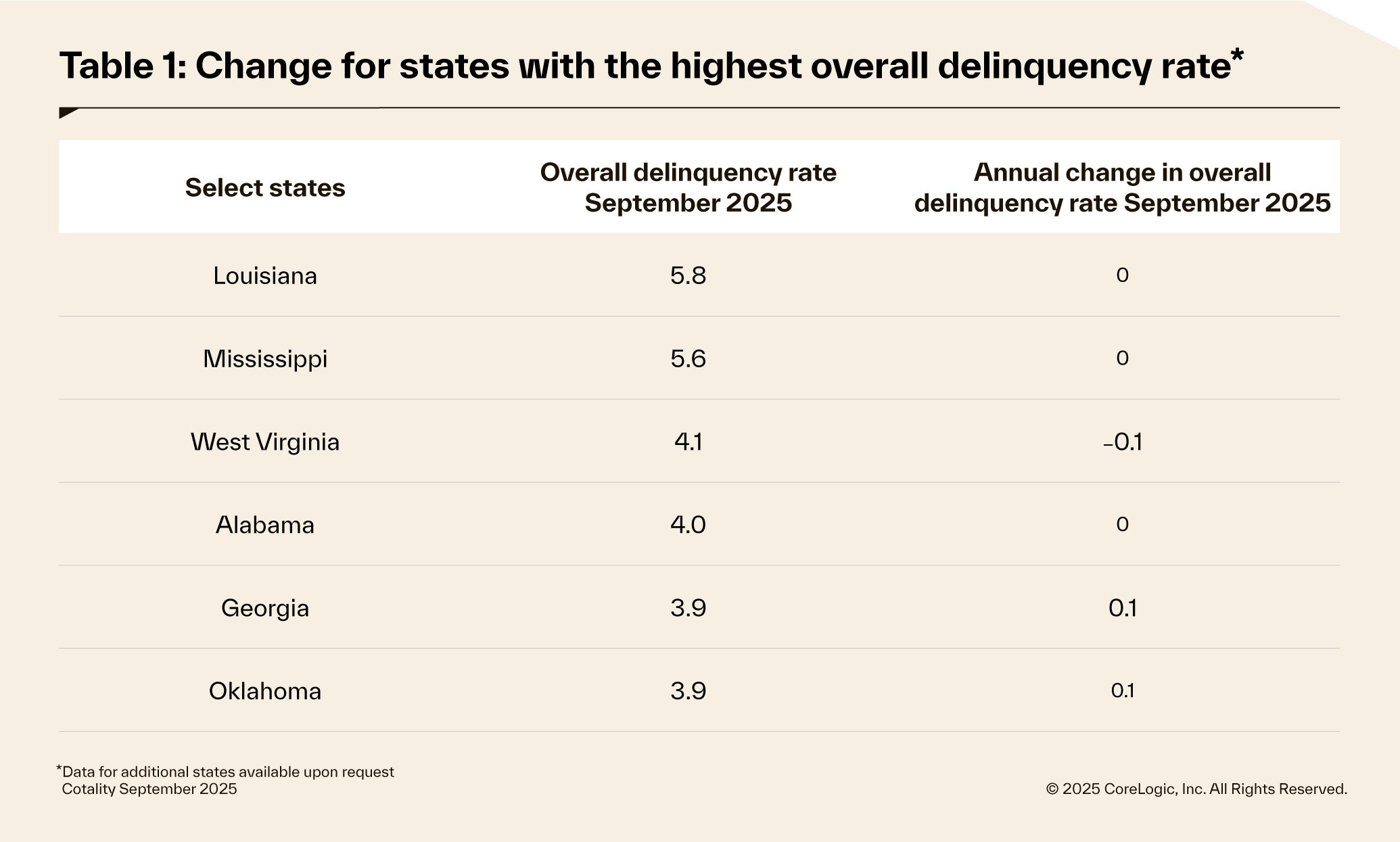

State and Metro Takeaways

In September 2025, 18 states logged year-over-year increases in their overall delinquency rate. The locations with the highest increases were Arizona, Nevada, and Georgia which were all up 0.2 percentage points. All other states had changes ranging between -0.2 and 0.1 percentage points.

In September 2025, 186 out of 384 U.S. metropolitan areas posted an annual increase in their overall delinquency rate. The top areas include: Odessa, Texas (up 1.3 percentage points); San Angelo, Texas (up 1 percentage point); Farmington, New Mexico, and Jonesboro, Arkansas (both up 0.8 percentage points). All other year-over-year changes ranged between -0.8 and 0.7 percentage points.

In September 2025, 174 metropolitan areas posted an annual increase in their serious delinquency rate. The top areas include San Angelo, TX (up 0.5 percentage points); Odessa, TX; Lakeland-Winter Haven and Cape Coral-Fort Myers, FL; and Lima, OH (all up 0.4 percentage points). All other year-over-year changes ranged between -0.7 and 0.3 percentage points.

The next Cotality Loan Performance Insights Report will be released on February 27, 2026, featuring data for the fourth quarter of 2025. For ongoing housing trends and data, visit the Cotality Insights Blog.

Methodology

The data in the Cotality LPI report represents foreclosures and delinquency activity reported through September 2025. The data in this report accounts only for first liens against a property and does not include secondary liens. The delinquency, transition, and foreclosure rates are measured only against homes that have outstanding mortgages. Homes without mortgage “liens” are not subject to foreclosure and are, therefore, excluded from the analysis. Cotality has approximately 75% coverage of U.S. foreclosure data. This data is compiled from public records, contributory databases, and proprietary analytics, and its accuracy is dependent upon these sources.

Source: Cotality

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished, or licensed to any other source, including publications and sources owned by the primary recipient’s parent company, without prior written permission from Cotality. Any Cotality data used for publication or broadcast, in whole or in part, must be sourced as coming from Cotality, a data and analytics company. For use with broadcast or web content, the citation must directly accompany the first reference of the data. If the data is illustrated with maps, charts, graphs, or other visual elements, the Cotality logo must be included on screen or website. For questions, analysis, or interpretation of the data, contact newsmedia@cotality.com. Data provided may not be modified without the prior written permission of Cotality. Do not use the data in any unlawful manner.

About Cotality

Cotality accelerates data, insights, and workflows across the property ecosystem to enable industry professionals to surpass their ambitions and impact society. With billions of real-time data signals across the life cycle of a property, we unearth hidden risks and transformative opportunities for agents, lenders, carriers, and innovators. Get to know us at www.cotality.com.

Media Contact

Carly Owens

Cotality