Manage physical and transition climate risks with confidence

In 2026, climate risk has become central to risk management and investment planning.

Lenders must now prove the resilience of their mortgage books.

Landlords are scoping the impact of minimum energy efficiency standards on their homes.

And local authorities want to understand the impact of risks on their residents.

From risk to resilience

Cotality has developed best-in-class climate risk datasets, with trusted, proven analytical tools.

From EPC reporting to address-level physical and transitional risk analytics and powerful scenario testing, we give lenders, landlords and local authorities confidence in managing climate risk.

100%

of GB homes have a digital twin on our platform, with ability to add owner or lender-held data.

2 million+

homes analysed for UK landlords, in private and social housing

0.5 million

homes under full climate risk analysis for lenders

Essential tools for climate risk management

Financed emissions

Reporting ready for investors, ratings agencies and regulators with the latest, detailed data, and track changes over time. Data audit trail and our Government-approved calculation engine provide transparency and confidence.

Compliant calculations

Measure and report emissions associated with your housing portfolio, along with costs of meeting minimum standards, with metrics, method and audit trail to meet ICAAP, PCAF, IFRS S2, FCA and UN SDG's requirements

Stress testing

Using market-leading retrofit analysis, incorporating latest market costs and measures, evaluate the resilience of your portfolio against different policy scenarios and meet the requirements of IFRS S1 and S2 regulation.

Physical risk

UPRN level granularity layering your property data with different climate scenarios and timeframes provides exceptional insight into physical risks such as flooding, subsidence, overheating, coastal erosion, wind, hail and wildfire.

Green finance opportunities

Detailed data, intuitive analytics and flexible options analysis enables investors to identify and understand suitability for green securitisation and RMBS, and model the market potential for new products.

Quality assured advice and installation

You know homes require investment, what next? We offer a range of services, from online advice and surveys to quality assured installation, delivering measures that meets investor and owners' needs.

Tools tailored to your requirements, powered by address-level data and powerful, government-approved modelling

Transform risk into resilience with Cotality. Our products equip finance and housing professionals with digital twins, market intelligence and 30-year predictive modelling to assess asset-level climate risk.

Quantify exposure, streamline regulatory reporting, and drive data-backed investment decisions.

Beyond EPC: high-resolution data for climate risk management

EPC data is not enough.

Data is at the heart of effective energy and climate performance planning and reporting

It drives investment decisions, and needs to be continually updated to reflect changes in the market, technology, and government policy.

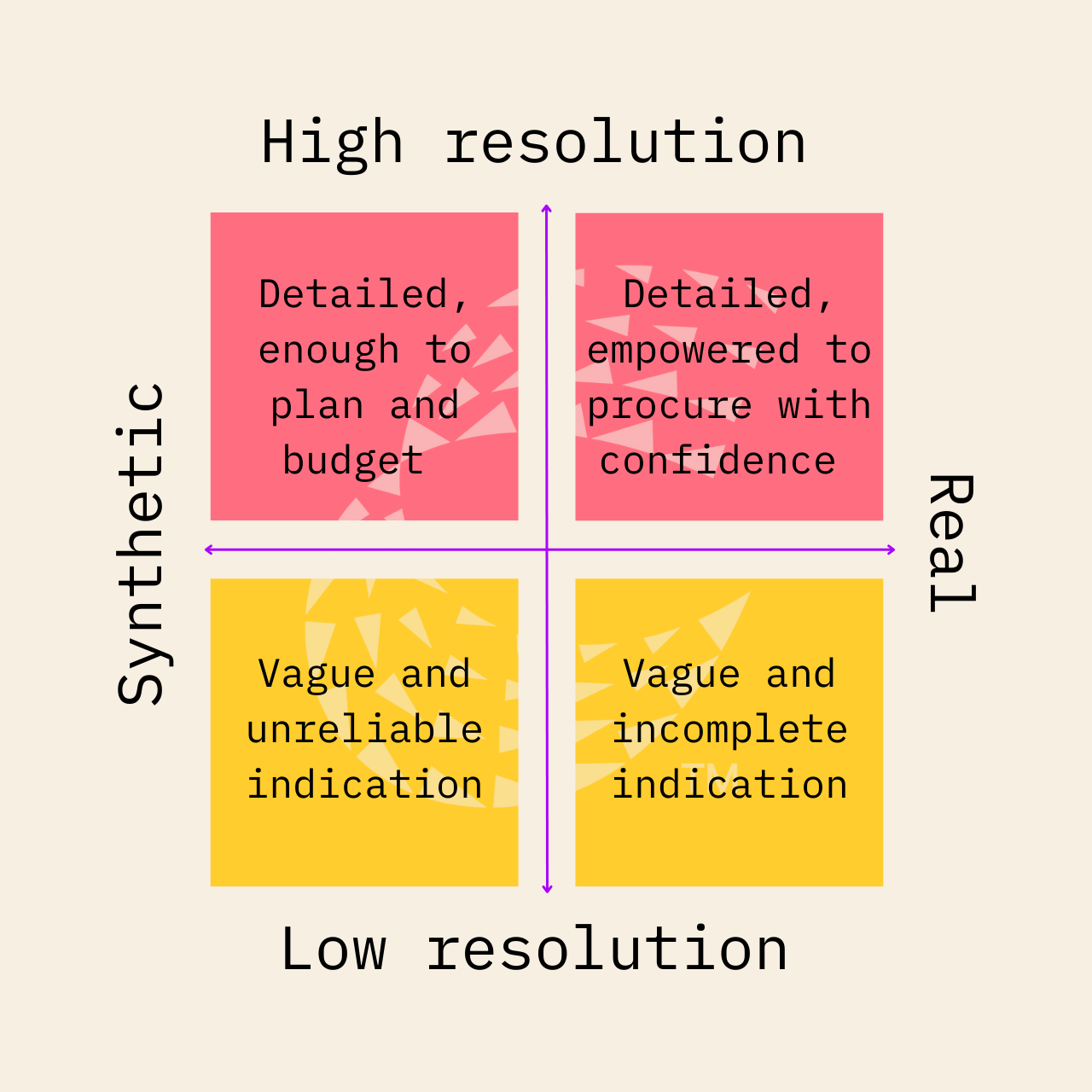

Low resolution, outdated or ultra-simple synthetic data delivers insights that can leave users - homeowners, landlords, contractors, lenders or insurers - with unreliable outputs, inappropriate recommendations and inaccurate cost estimates.

Cotality data is high resolution, regularly refreshed, with transparency on sources and data confidence.

Available to housing and finance professionals to manage climate risks via Cotality tools and API, now.

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.