Press Release

•

March 20, 2025

US Annual Single-Family Rent Growth trends upward to start 2025

- U.S. Single-family rent prices increased 2.4% year-over-year in January 2025.

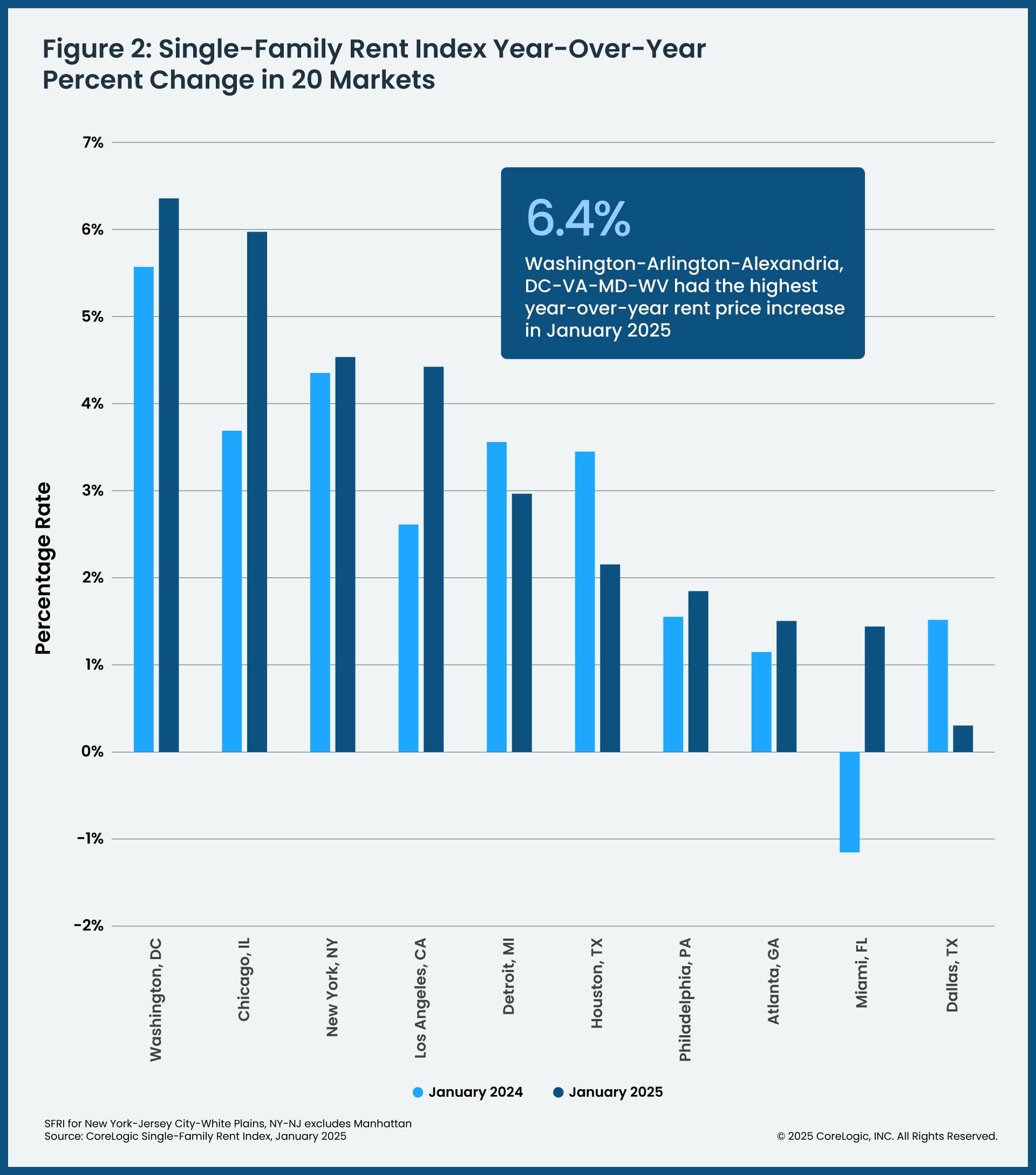

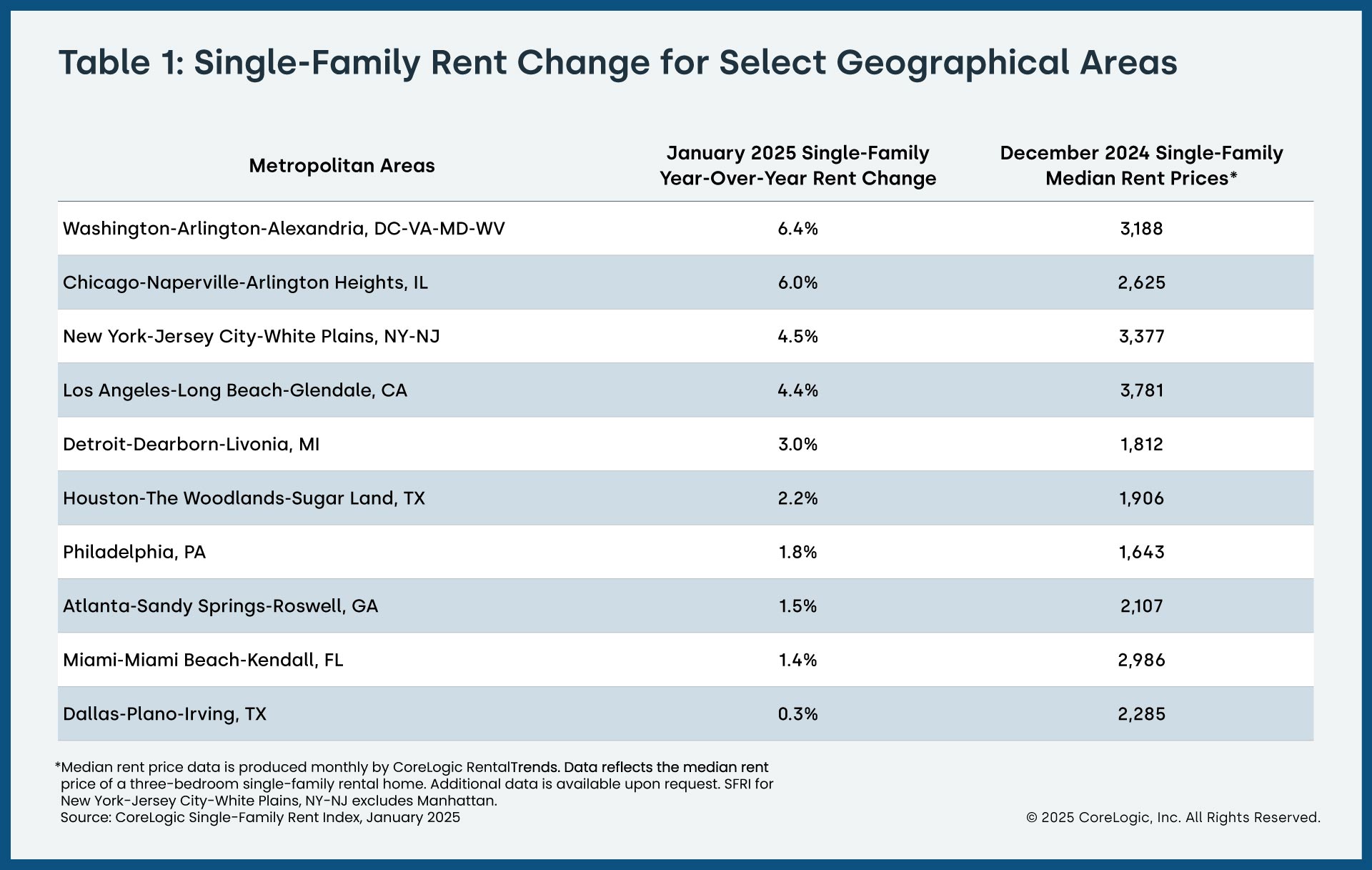

- Washington, D.C., had the highest year-over-year rent price increase at 6.4% in January 2025.

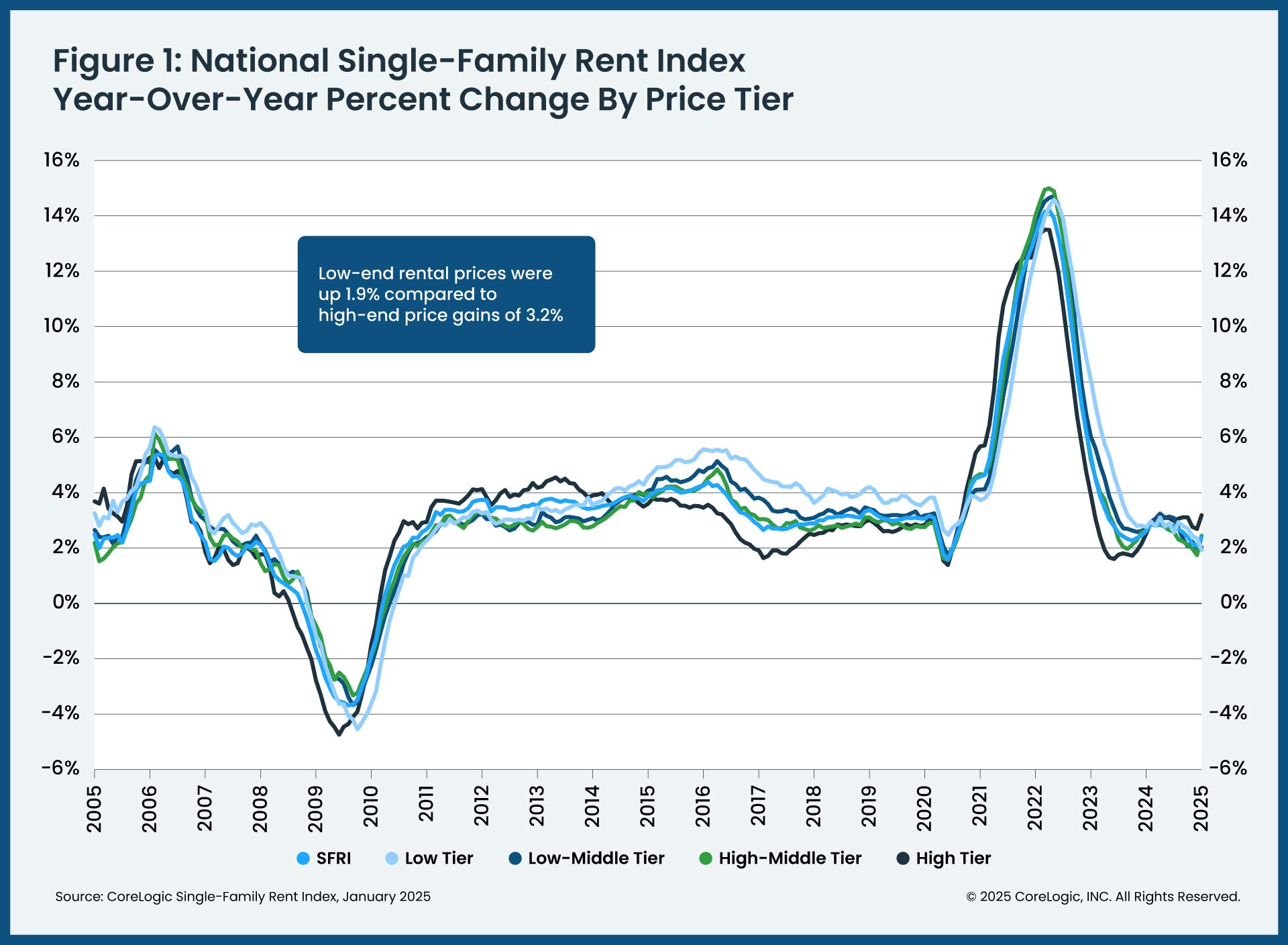

- Low-end rental prices were up 1.9% compared to high-end price gains of 3.2%.

IRVINE, Calif., March 20, 2025 — CoreLogic®, a leading global property information, analytics, and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

Single-family rent prices increased 2.4% year over year in January 2025, up from the previous month’s 2.1%. This is down from January 2024, when rent prices grew 2.6%. Prior to 2020, single-family rent growth increased in the range of 2-4% for nearly a decade and averaged 3.5%.

The monthly growth rate for January was 0.4%, which was above the average of 0.1% for January from 2004-2019, marking the first month since mid-2024 that monthly growth has been above the seasonal trend.

"After a period of slowing annual growth, single-family rent increases are firming up. Annual single-family rent growth in January ticked up from what may have been the cycle low point in December 2025. Furthermore, January's monthly increase was above what is typically recorded in the winter months, and it was the first above-trend monthly increase since mid-2024. This uptick signals renewed pressure on renters, potentially exacerbating the housing affordability crisis," said CoreLogic senior principal economist Molly Boesel.

Rent prices for high-end properties increased 3.2% year over year in January, a gain from the 2.5% growth seen at the same time last year. In contrast, low-end rent prices increased 1.9% year over year in January, a slowdown from the gain of 2.8% seen in January 2024.

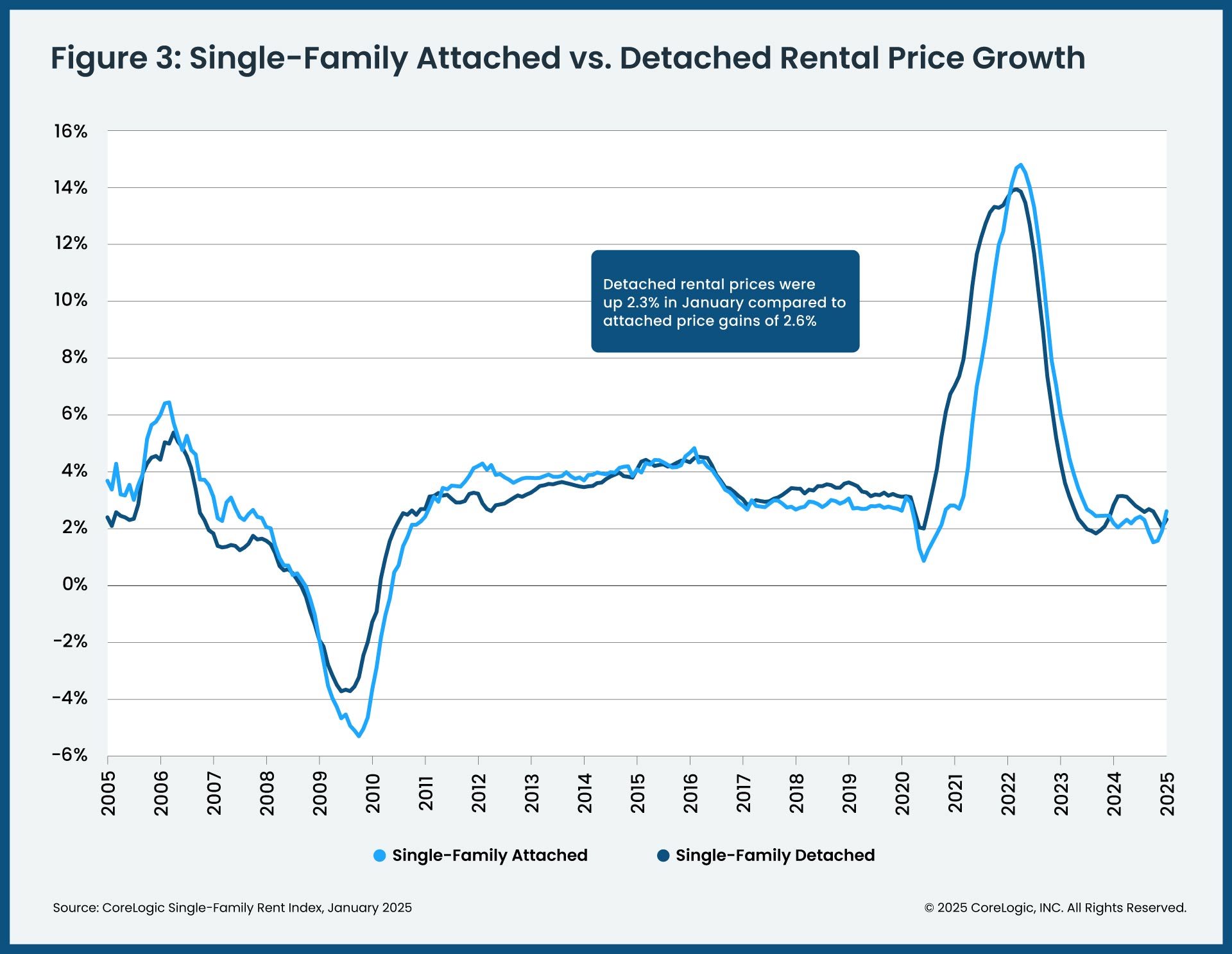

Rent growth across property types ticked up in January 2025, with detached rentals experiencing a growth of 2.3% and attached rentals growing 2.6%.

Washington, D.C., posted the highest year-over-year increase in single-family rents in January 2025 at 6.4%. Chicago followed closely behind at 6.0% growth. Dallas continued to have the lowest growth at just 0.3% in January 2025, followed by Miami at 1.4% and Atlanta at 1.5%.

While Washington, DC, and Chicago had the highest growth in January, the Florida markets saw the highest growth since 2020. Single-family rent in Miami is up 52%, while Washington, DC grew 30% and Chicago grew 25%.

The next CoreLogic Single-Family Rent Index will be released on April 17, featuring data for February 2025. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The CoreLogic Single-Family Rent Index (SFRI) applies a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. The rental listings used to calculate the index include both attached and detached single-family homes, as well as condominiums. This report shows trends for the U.S. and the largest 10 U.S. metropolitan areas. In addition to these 10 metros, the CoreLogic SFRI is available for close to 100 metropolitan areas — including approximately 4 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic Rental Trends. Rental Trends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Charity Head at newsmedia@corelogic.com. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

###

Media Contact:

Charity Head

CoreLogic