Press Release

Mortgage fraud risk continues its upward trend to end 2025

Cotality National Mortgage Fraud Application Risk Index shows risk is at 133 for Q4 2025

- An estimated 1 in 118 mortgage applications had indications of fraud.

- Investor and multi-family spaces are most at risk for mortgage fraud.

- Undisclosed real estate fraud risk saw the largest increase in Q4 2025.

IRVINE, Calif., February 5, 2026 – Cotality, a leading global property information, analytics, and data-enabled solutions provider, released the Cotality National Mortgage Application Fraud Risk (Index) for Q4 2025. The index is 133, a slight increase from Q3. The year-over-year trend is up 1.5% from Q4 2024, when the index stood at 131. The Q4 Fraud Index translates to an estimate of 1 in 118 applications having indications of fraud.

Cotality’s data shows that year-over-year, the two highest risk categories continue to be in the investment and multi-family spaces. The data shows that an estimated 1 in 43 investment applications and 1 in 27 multi-family applications have indications of fraud risk in Q4, compared to an overall industry average of 1 in 118.

“The percentage of refinances in the Cotality data set has increased year-over-year by 19%, yet the Fraud Index is up 1.5% over that time. This is significant because historically, refis bring a much lower risk of fraud than purchases,” said Matt Seguin, Cotality Mortgage Fraud Solutions senior principal. “The two riskiest segments of the fraud index, investment properties (+34%) and multi-unit properties (50%), have jumped significantly over the last year as a portion of the overall application volume seen by Cotality. The increase in volume in these two segments has led to a slight increase in the Fraud Risk Index. This change seems to have been driven, at least partially, by the surge in popularity of the DSCR loans.”

Real estate fraud risk saw the largest year-over-year increase in Q4 2025 at 8.6%. This increase appears to be driven by more volume in investment property applications. Based on the last three months of data, non-owner-occupied homes triggered undisclosed real estate alerts at a rate more than 2.5 times the rate of owner-occupied homes. Undisclosed real estate fraud risk may also result in undisclosed debt, possible occupancy misrepresentation, and/or derogatory credit events (foreclosure, notice-of-default, short sale, etc.) being hidden from the lender.

All other Fraud risk categories showed year-over-year decreases. However, Cotality analyzed our most predictive alerts and saw increasing trends in Q4 around income, property, and occupancy risk areas.

- Income: Increase in alerts related to employer information that cannot be validated by phone and/or address.

- Property: Jumps in alerts related to possible flipping of the subject property and inflated value when the subject has transferred ownership and had gains of 100% or greater in the last 24 months of sales.

- Occupancy: Increased alerts that a primary or a second home will not be occupied as disclosed. This includes claiming owner occupancy on a multi-unit purchase when other properties are owned by the borrower, as well as a primary refinance with a different tax mailing address.

Cotality saw overall mortgage applications decrease <1% from Q3 to Q4. Purchase share continues to decrease to 62% of transactions. Government-backed shares remained steady at 24% of applications.

Cotality’s Q1 2026 Mortgage Fraud Report will be released in May 2026. For more on mortgage fraud, and ongoing housing trends and data, visit the Cotality Insights blog.

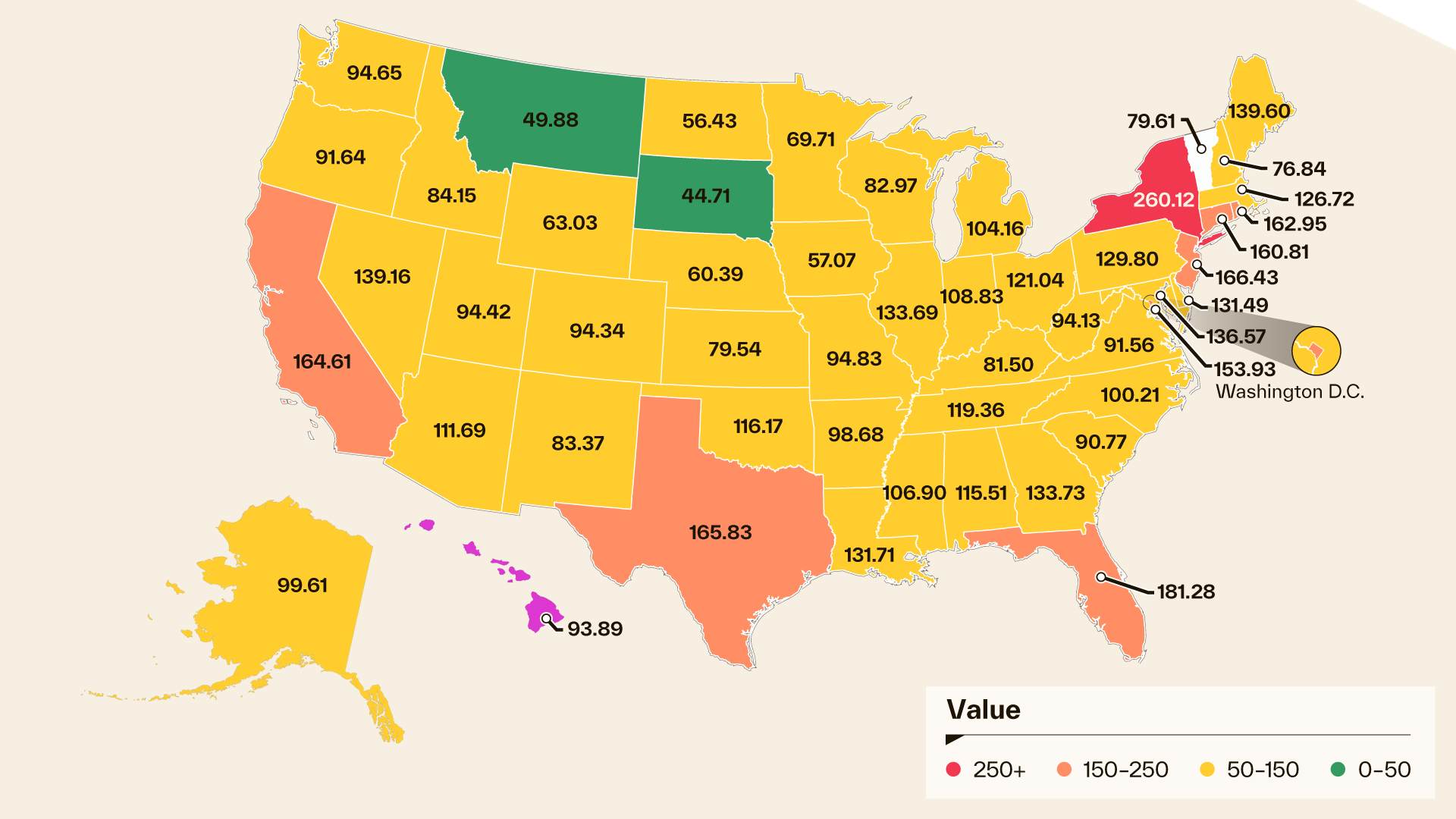

Mortgage fraud risk across the U.S.

Data source: Cotality, 2025

METHODOLOGY

The Cotality National Mortgage Application Fraud Risk Index analyzes the collective level of loan application fraud risk the mortgage industry is experiencing each quarter. CoreLogic develops the index based on residential mortgage loan applications processed by Cotality LoanSafe Fraud Manager™, a predictive scoring technology. The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction, and undisclosed real estate debt.

About Cotality

Cotality accelerates data, insights, and workflows across the property ecosystem to enable industry professionals to surpass their ambitions and impact society. With billions of real-time data signals across the life cycle of a property, we unearth hidden risks and transformative opportunities for agents, lenders, carriers, and innovators. Get to know us at www.cotality.com.

Media Contact

Charity Head

Cotality